For proponents of the Internet of Things, the last 12-18 months have been often frustrating. The Internet of Things (IoT) was supposed to be huge by now. Instead, the industry news has been dominated by a string of startup failures, as well as alarming security issues. Cisco estimated in a (controversial) study that almost 75% of IoT projects fail. And the Internet of Things certainly lost a part of its luster as a buzzword, easily supplanted in 2017 by AI and bitcoin.

Interestingly, however, the Internet of Things continues its inexorable march towards massive scale. 2017 was most likely the year when the total number of IoT devices (wearables, connected cars, machines, etc.) surpassed mobile phones. Global spending in the space continues to accelerate – IDC was forecasting it to hit $800 billion in 2017, a 16.7% increase over the previous year’s number.

The reality is that the various parts of the IoT ecosystem are not evolving at the same speed. Ultimately the Internet of Things covers several industries rather than one.

The Internet of Things is unified by a common principle (extracting and analyzing digital data from the physical world), as well as common characteristics (combination of hardware and software), opportunities (personalization and intelligence, real-time services) and challenges (connectivity, security, etc.). Beyond those, however, areas as diverse as home automation, commercial drones, industrial machinery or autonomous cars are subject to very different industry dynamics.

It’s been almost two years since our last attempt at charting this vast universe of exciting technologies and companies. (“Are we There Yet? The 2016 IoT Landscape”), and, often behind the scenes, a lot has been happening.

Our overall take: the Internet of Things is going through a phase of early adolescence – a lot is being built in different places, not all of it looks pretty or behaves as desired, but a lot of foundational growth is happening.

Let’s dive in.

Hot trends and topics

AI everywhere

The promise of the IoT was always to create “smart” objects – it is certainly nice to get data from the physical world and gain more insights, but ultimately the whole point is to act on that data, ideally in an automated, real-time and intelligent way. This is exactly what AI enables.

In 2017, AI exploded in mainstream collective consciousness, a trend that we’ve covered extensively in our 2017 Big Data and AI landscape and other posts.

Just as in many other industries, AI has now become a huge part of the IoT conversation.

On the consumer front, AI is at the core of some of the most exciting areas. Voice platforms, indisputably one of the brightest spots in consumer IoT, have become a battleground between Amazon Alexa and Google Assistant (with Apple, Samsung, Tencent, Alibaba and many others joining the fray). It is very clear that the fight is not about selling hardware – while it has a number of its own products (Echo, Dot, etc.), Amazon is on a mission to deploy Alexa on third party hardware, including Sears, Kenmore and a variety of wearables or home automation product (including security camera Canary, based on a CES announcement today). The ultimate goal is to amass massive amounts of data and build data network effects to constantly improve the AI. If voice truly becomes “the UI of the future”, then whoever has the best AI will win the war.

Similarly, the general area of autonomous vehicles, which received enormous amounts of attention and investment in 2017 (expect that trend to continue in 2018) is fundamentally an AI play. While we’re probably much further away from Level 5 fully autonomous driving than the current hype would lead us to believe, the underlying AI has made extraordinary progress in the last couple of years, including in how it is trained or, as it were, trains itself. What started as a physical world effort, with cars driving around to collect data, has increasingly become a virtual training effort. One of the best articles of 2017 is this Atlantic piece about how Waymo has driven its self-driving cars for a few million miles in the real world, but a few billion miles in a custom-built simulated, virtual word.

In the enterprise and industrial IoT (IIoT) world, too, machine learning and AI have become a key topic. Unlike their consumer IoT cousins that require a big commercial “hit” with their product to be able to gather enough data for truly meaningful AI, IIoT companies can leverage their industrial customers’ data. Many machines, assembly lines and oil rigs already have thousands of sensors on them. Of course, obstacles abound, both technical (the data is often “trapped” and hard to extract) and cultural (transitioning from decades of statistical analysis on small samples to a new software driven approach, in a context where failure can be catastrophic). However, AI can be a complete game changer in those industries. (For more, see a couple of very interesting talks from our monthly Hardwired NYC event by Alluvium and Fero Labs).

Beyond those examples, AI is the process of becoming ubiquitous across the stack, from non-obvious applications like vertical farming to infrastructure like edge computing (see below).

Outside of AI, worth noting that the IoT also benefits from, and blends with, progress in related areas such as material sciences, genomics and nanotechnology, which are also experiencing their own rapid evolution. More on this in 2018 and beyond.

Security: increasingly unnerving

If there was any remaining doubt that security is a major issue for the Internet of Things, the past 18 months have eliminated it entirely.

Starting in particular with the Mirai “Botnet of Things” back in September 2016, which earned the dubious distinction of being one of the “Breakthrough Technologies of 2017” according to the MIT Technology Review, the list of hacks and other security embarrassments has kept growing: in February, connected toymaker CloudPets was hacked and held for ransom; in March, an automatic firmware update broke Lockstate connected smart locks for 500 customers; in August, 8,000 Telnet credentials of IoT devices were exposed on the Internet, etc. As of the time of writing (early January 2018), someone released publicly the working code to hack Huawei routers used by the Satori botnet, opening the door to more attacks and more powerful botnets.

It seems inevitable that more severe attacks will occur in the near future. (see for example, Krebs on Security for recently published concerns about a far more powerful strain of IoT attack malware, named “Reaper” or “IoTroop”).

In our conversations with IoT startups, it has become apparent that, to this day, security too often continues to be an afterthought.

This is not out of malice or irresponsibility – in fact, at least in surveys, many IoT developers now consider security to be a top concern. However, the reality is that the topic tends to drop down the priority list given the many immediately pressing challenges involved in just shipping an IoT product. It doesn’t help that IoT security is a complicated topic that’s very much outside the area of expertise of the average IoT developer, requiring a disproportionate amount of time and effort for an outcome that doesn’t immediately help sell the product.

Certainly, a cottage industry of startups has emerged around IoT security (see relevant box in our IoT landscape), and many of the larger traditional security vendors have come up with an IoT solution (or, at least, an IoT-centric marketing message). However, those companies typically target critical security needs in Fortune 1000 companies, leaving the needs of the average startup developer (or under-budgeted developer in a larger company) unmet.

The emergence of an IoT cloud infrastructure (see below) will certainly help. Sadly, however, we will see more damaging, large-scale and widely-reported attacks before security becomes an absolute baseline requirement.

Worth noting, last summer a new bill was introduced – The IoT Cybersecurity Improvement Act of 2017 – that set baseline IoT security standards for IoT devices sold to the government, including routers and security cameras (Krebs on Security). This was essentially an attempt to leverage the full weight of the Federal Government’s IT budget to send a clear signal to the IoT industry. The bill has not yet passed.

The IoT, now with blockchain

It was hard to escape the bitcoin and overall crypto-mania in 2017, and the IoT industry was no exception. Typically, the intersection of two buzzy, emerging concepts such as the IoT and the blockchain would sound like a hazardous place. It might very well be. However, it is hard not to be intrigued by the possibilities, in several domains.

First and foremost, security: because of its decentralized nature and its strong protections against data tampering, the blockchain lends itself well to the type of complex security problem involved in massive network of connected objects.

In addition, the blockchain could open up powerful opportunities for IoT data exchange. This could be done between enterprises, leveraging private blockchain infrastructure to enable business partners to access and supply IoT data without the need for central control and management. Each partner would be able to verify each transaction, ensuring accountability and avoiding disputes (see, for example, IBM and its HyperLedger-powered efforts). This could be also done at a global level, as a decentralized data marketplace, which is in essence what the (controversial) IOTA organization is purportedly trying to do.

Another promising area for leveraging the blockchain is general connectivity. Interesting work is being done by startups like Filament (long-range wireless networks to connect machinery and industrial infrastructure to the network) and Helium (a FirstMark portfolio company), which will soon announce ambitious plans in the area (for more context and a great talk on the state of IoT in general, see a great quick talk by CEO Amir Haleem at Hardwired NYC).

Financings and exits: a quiet year

Since our last landscape in 2016, the IoT financing market has gone from explosive growth to a much more cautious pace, although dollars invested remain high in the aggregate.

In fact, according to CB Insights data, the total amount of VC dollars invested in IoT in 2017 (Seed to Series E+) went down compared to 2016: $3.77 billion in total, vs $3.83B in 2016, a 1.6% decrease. (Those numbers correspond to what CB Insights categorizes as Internet of Things, and don’t necessarily include all the companies on the landscape).

As in other parts of the venture world, but perhaps more so in IoT, the key story here has been an evolution towards larger, more concentrated investments in a smaller number of companies, typically at the growth stage. This is evidenced by a sharp decrease in the total number of deals: 295 financings in 2017, down 37.9% from 475 financings in 2016.

Not so long ago, most IoT startups were Seed or Series A companies. Some companies that have been able to scale are now tapping into growth stage money.

Meanwhile, the well has dried up a bit for Seed and Series A ventures. In 2016, about 73% of VC deals were at the Seed and Series A level; in 2017, this number dropped to 53%.

As in previous years, one of the peculiarities of the IoT VC market is that the most active investors in the space are disproportionately corporate venture arms: Intel Capital and GE Ventures top the list, with Qualcomm Ventures not too far behind. As many traditional VCs shy away from hardware, those funds have played an enormous role in buoying the space.

The gigantic Softbank Vision Fund made a resounding entrance into the space. The Internet of Things is a core pillar of the $100 billion’s fund investment thesis (and of Softbank in general, as evidenced by the $32 billion acquisition of ARM back in September 2016, which was positioned as a bet on the Internet of Things). The Softbank Vision Fund made a number of large bets, including vertical farming company Plenty ($200M Series B), mapping company Mapbox ($164M Series C), autonomous vehicle system Nauto ($159M Series B), autonomous robot company Brain Corp ($114M Series C). For good measure, Softbank also acquired stakes in NVIDIA, iRobot and IIoT company OSISoft and bought robotics firms Boston Dynamics and Schaft from Alphabet.

Other noteworthy financings in 2017 included connected indoor cycling company Peloton ($325M Series E); smart window company View ($200M Series G); IIoT analytics company Uptake ($117mm – Series D); 3D printing company Desktop Metal ($115mm Series D); smart doorbell company Ring ($109mm in Series D and debt); cloud robot operator CloudMinds ($100M Series A); Chinese robotics company Ninebot ($100M Series C); Japanese AI/IoT platform Preferred Networks ($95.4M Strategic Round); security company Forgerock ($88M Series D); French LPWA connectivity company Actility ($75M Series D); security company SentinelOne ($70mm Series C) and IoT middleware platform Ayla Networks ($60M Series D — see Ayla’s talk at our Hardwired NYC event).

On the M&A front, the big exits of 2017 involved companies that were already public (as opposed to startups). The two big acquisitions of the year were major bets on connected cars and autonomous vehicles: Intel purchased AI/computer vision company Mobileye for $15 billion and Samsung acquired connected car solutions specialist Harman for $8 billion. The next largest acquisition was in IoT security, with the just-announced purchase of Gemalto by Thales for approximately $5.6 billion. Also worth noting: Itron acquired mesh connectivity specialist Silver Spring Networks for $830 million; Sierra Wireless acquired full stack managed platform Numerex for $107M; and OpenText bought IoT middleware platform Covisint for $103M.

In terms of IoT startup exits, 2017 was a poor year. On the relatively short list of noteworthy acquisitions, all noteworthy acquisitions, none cleared the $500 million mark. Continental purchased automotive cyber security startup Argus for a rumored $450 million; Delphi acquired autonomous vehicle startup nuTomy for $400 million upfront (plus a $50 million earn-out); John Deere bought agriculture machine learning company Blue River for $305 million, Assa Abloy acquired smart lock maker August for an undisclosed amount; and Prodea acquired IoT platform Arrayent for an undisclosed amount as well.

Finally, it was a pretty meager year in terms of IPOs as well. Companies that went public include Switch Inc., a data center infrastructure company with a focus on the “Internet of Everything” and cybersecurity company ForeScout Technologies, which enables enterprises to track IoT devices accessing their network.

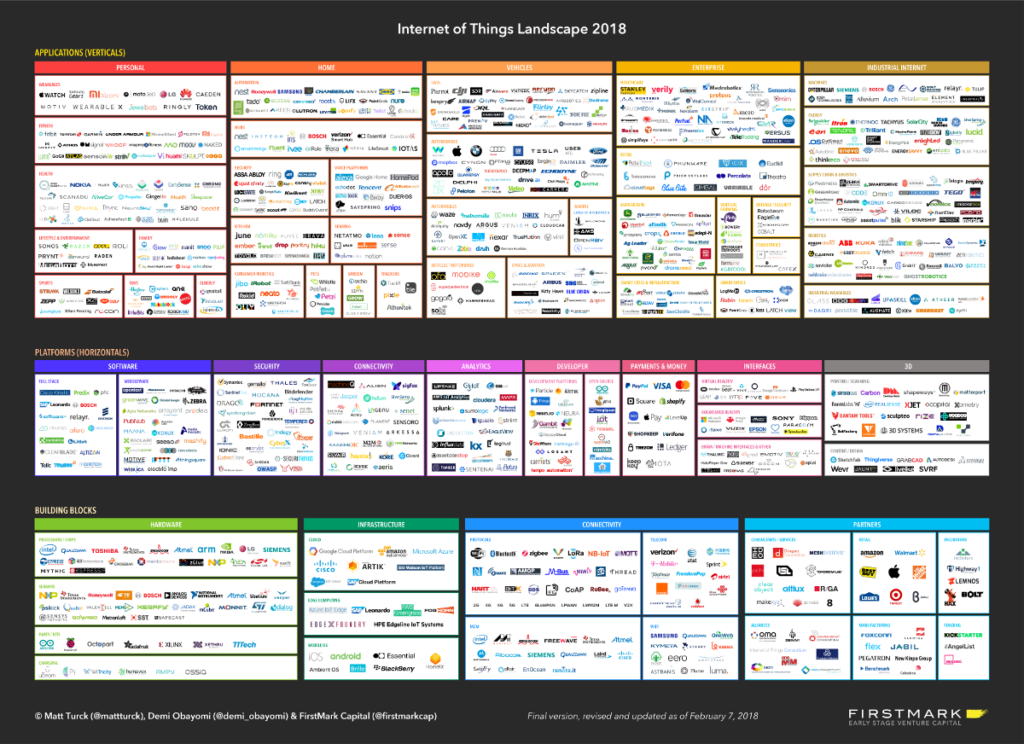

The 2018 IoT Landscape

To see the landscape at full size, click here. To view a full list of companies, click here. The chart’s format will preserve high resolution when zooming in to individual logos, both on desktop and mobile. Zoom away!

This is our fourth Internet of Things landscape (see 2013, 2014, 2016). This version was prepared with invaluable help from FirstMark associate Demi Obayomi. Our methodology for inclusion is summarized at the end of this post.

This year, we created a few new sub-categories, reflecting emerging trends: voice platforms, marine vehicles, vertical farming and edge computing.

There are 971 logos on the chart, vs 721 in 2016, a 34.7% increase. 96 companies were removed from last year’s chart; 346 new companies were added. A small number of typically very large companies have their name in several categories.

For the rest of this post, we’ll highlight some key areas of the chart, starting from the top (“Applications / Verticals”) and navigating to the bottom (“Building blocks”).

APPLICATIONS / VERTICALS

Consumer IoT: The End of the Grand Experiment

In case anyone missed it, consumer IoT startups just had a pretty bad year.

At the time of writing, smart lock maker Otto (which had raised $37M in venture capital) is the latest casualty in a long list of companies that ceased operations over the last 18 months. The list also includes: sleep tracker Sense ($2.4M Kickstarter campaign; $40M in VC investment); Life-logging camera Narrative ($12M in VC investment); consumer drone company Lily ($34M in pre-sales; $15M in VC investment); AR motorcycle helmet maker Skully ($15M in VC investment); connected tea-infuser Teforia ($17M in VC investment); smart earbuds company Doppler Labs ($50M in VC investment); and, most famously, connected juice machine Juicero ($118M in VC investment).

The list would be longer if one added a number of underwhelming acquisitions of both consumer companies (Pebble, Electric Objects, etc.) or B2B2C platforms (Zonoff acqui-hired by Ring; Wink acquired by… Will.i.am).

Much later stage startups and even public companies were also in turmoil, with Jawbone going out of business ($1 billion in total funding), and Fitbit, GoPro or Parrot considerably down from their 2015 or 2016 stock prices. As of time of writing, GoPro just announced it was exiting its drone business, laying off 20% of its staff and exploring a possible sale.

What’s going on?

We’re witnessing the end of a first phase, which in retrospect feels like a “grand experiment“. Rewind to 2012 or 2013, when the whole excitement about consumer IoT re-ignited (after another false start a decade before that), and there were two fundamental hopes.

The first hope was that adding connectivity to an object would change everything. Once connected, dumb devices would morph into objects of desire, driving strong consumer demand and commanding high prices.

The second hope was that hardware was becoming “less hard”. Many IoT entrepreneurs were new to the space, but with open source, commoditized components, new development platforms, 3D printing and crowdfunding, they would be able to iterate almost the way software entrepreneurs could.

Early successes like Nest and Oculus VR seemed to usher in a new era. A Cambrian explosion of new companies and products followed.

Fast forward to today, and consumer IoT startups have experienced a brutal re-entry into reality.

Connectivity did not change everything. As the founder of Big Ass Fans summarized in one of our favorite articles of the year,: “just because you can make something with IoT technology doesn’t mean people will want it“. Early adopters will be willing to pay higher prices in return for novelty. But expanding to the mainstream consumer will require undeniable value beyond the coolness factor.

In addition, hardware entrepreneurship has not become that much easier. Design mistakes continue to be costly, supply chain problems abound, retail is difficult. A lot has improved, but the fundamental reality of creating, assembling and moving atoms, generally across various points of the planet, remains fundamentally unforgiving.

Finally, competition from large companies has been intense for startups, both from Asian (mostly Chinese) low-cost manufacturers and tech giants (both US and Asian). This was always a concern (we wrote about it in 2013 here), but in many ways things are worse now, as large players went from experimentation to pushing their full weight into the opportunity.

Of course, this does not mean that consumer IoT startups are doomed.

For all our comments above, startups fail all the time, it is the nature of the beast. Part of what is happening is a natural phenomenon of attrition in a field that grew explosively for 3 or 4 years, probably to unsustainable levels. Those failures are perhaps more public, because those companies got a fair amount of attention in the press and on crowdfunding websites when they first launched.

Some consumer IoT companies are scaling well, and raising large amounts of money at the growth stage. We mentioned a couple of examples above: Peloton, the connected cycling/fitness company, raised a $325M Series E round of funding in 2017, the largest round of any IoT startup last year, as far as we know (see Peloton’s talk at Hardwired NYC). Ring, the connected doorbell company, raised $119M in Series D and debt in 2017, and continues to scale (but is now faced with increased competition from both Alphabet/Nest and Amazon).

A whole new generation of hardware entrepreneurs has been created. Over time, we expect that all the experience accumulated over the last few years will result in great new consumer companies, with more battle-hardened veterans from both successful and failed IoT startups.

Industrial IoT: from horizontal platforms to vertical, AI-powered solutions

Compared to consumer IoT, the B2B side has fared substantially better. The Industrial IoT (IIoT), in particular, has continued to gain attention from startups, VCs and large conglomerates, as part of a broad “Industry 4.0” theme that also includes robotics and enterprise 3D printing. Just like the industries it serves (manufacturing, energy, logistics, transportation, etc.), the Industrial IoT opportunity is very large.

While the IIoT falls in the general category of enterprise technology, with correspondingly long sales cycles, one advantage that IIoT startups have over many of their consumer IoT cousins is that they generally don’t require a complete reinvention of behaviors within industries. They mostly offer ways of better extracting and analyzing data from machines, whether in factories or oil fields, something large industrial conglomerates have done, to some degree, for many years. Therefore, they can blend themselves more easily into existing workflows, including in connection with existing Operational Technology (OT) frameworks, and have a greater ability to demonstrate a clear ROI.

That said, the IIoT space remains early. Various core technical problems, starting with connectivity in remote or hot environments, are still not well solved. Before being able to run AI (as per the above), one needs to extract data, and this often remains a difficult problem, particularly considering the wide range of legacy machinery out there – something a whole range of startups (Augury, Arch Systems, Petasense, etc.) are actively working on.

On the whole, large industrials are still at the experimentation stage, running pilots with both startups and larger vendors. As another sign of overall industry immaturity, many internal IT teams at large industrials are considering building the required technology themselves – we have heard many tales of homegrown tinkering, with internal IT teams reportedly building systems on decidedly not enterprise-grade building blocks such as Arduinos and Raspberry Pis.

Regardless, one big lesson has crystallized over the last year or so: when it comes to IIoT platforms, there’s no “one size fits all’, meaning generic sensors or horizontal software that works across verticals with minimal customization. Confronted with the harsh reality of selling and deploying their systems to customers with different needs, many vendors, big and small, have had to change course and specialize in specific industries. For example, Samsara started with ambitions to build a horizontal platform, and has now refocused on fleet monitoring. Industrial giant General Electric, which started with an all-out horizontal effort for its Predix platform, has had to refocus on vertical applications.

HORIZONTALS

IoT Connectivity: Key infrastructure progress

Several years into the current wave of IoT innovation, how best to connect objects to the Internet (in a way that is reliable, scalable, battery efficient and cheap) remains a rapidly evolving, very competitive topic.

The vast majority of devices will most likely continue to connect through short-range connectivity technologies such as Wi-Fi, Bluetooth, Zigbee and Z-wave. Worth noting: while Wi-Fi has many advantages for in-building use cases (e.g., home automation), it also has significant drawbacks around power consumption and costs for a broader IoT usage. Emerging IEEE standards, 802.11ah and 802.11ax, may help but are still early.

For wide area connectivity (connections over a long distance), the situation is very much evolving.

One initial response has been Sigfox (a dedicated cellular network built by a French startup, well funded with about $310M in investment) and LoRA (also originally a French technology, acquired by Semtech in 2012, and promoted through the LoRA alliance). Those are Low-Power WAN (LPWAN) wireless technologies, designed specifically to interconnect low-bandwidth, battery-powered devices with low bit rates over long ranges.

In 2017 in particular, the big carriers jumped into the action forcefully, with two types of offering:

Narrow-Band IoT (NB-IoT) is a licensed standard (as opposed to unlicensed SIgfox and LoRa), backed by major telecom operators. NB-IoT had a big year in 2017, with Deutsche Telekom launching their first official service in Germany the Netherlands. As of the time of writing (January 2018), T-Mobile just announced that it was launching the first NB-IoT plan in the US. Dish Networks also made announcements towards an NB-IoT network, rumored to possibly be in partnership with Amazon.

Meanwhile, both Verizon and AT&T launched in 2017 their own IoT networks in the U.S. based on a competing wireless technology, LTE Cat M1.

Both NB-IoT and CatM1 technologies have their pros and cons but for use by massive fleets of IoT devices, cost will be a major factor. The new T-Mobile NB-IoT offering will cost $6 a year per connected device and was presented as “one-tenth of the cost of Verizon’s Cat-M plans”.

Finally, there are big hopes for 5G, with its dramatically faster data transmission capabilities, which could lend themselves very well to the more intense IoT use cases, such as autonomous vehicles. But it may take until well into the next decade to get widespread deployment of 5G, at least in the US.

BUILDING BLOCKS

The cloud giants are all in on IoT

The cloud was always part of the IoT discussion, but the last few years reflected a lot of uncertainty. One the one hand, the cloud giants seemed to largely operate under the assumption that their core cloud offering could address IoT needs without much additional work required. On the other hand, various IoT companies big and small were experimenting with building their own cloud offerings.

In 2017, the situation evolved dramatically. Microsoft added a number of important features (IoT Central, a fully managed SaaS offering for IoT customers who don’t want their own cloud; Azure IoT Edge for edge computing, see below; Time Series Insights, a new time series database, etc. ), as did Amazon (AWS IoT One-Click for simple devices to trigger Lambda; AWS IoT Device Defender to secure fleets of IoT devices; IoT Device Manager to remotely manage IoT devices at scale, etc.) And, perhaps most symbolically, Google jumped into the fray and launched IoT Cloud Core, which provides the ability to connect and manage remote IoT devices at scale, regardless of their location, as well as integration with other Google Cloud products like BigQuery, Dataflow, and Pub/Sub.

Meanwhile, General Electric pivoted away from building its own “Predix Cloud”, and instead focused on building applications on top of AWS, with upcoming support for Azure. Similarly, several startups we spoke with shelved their plans to build cloud technology and instead focused on solutions to send device data to the big public cloud providers.

The emergence of a powerful cloud infrastructure is a major development for the Internet of Things, as it offers the promise of considerably reducing the overall complexity involved in designing and securely deploying IoT devices, one of the biggest hurdles to the success of the space.

Certainly, the cloud may not work for all IoT customers, particularly in the industrial world that is highly protective of their data. Thankfully, the emergence of edge computing will increasingly enable those customers to process their data locally.

The Rise of Edge Computing

Edge computing has been a hot topic for a bit now, but it saw a real acceleration on 2017. The general concept is to have the intelligence pushed from the cloud to the edge, meaning the gateway, device or even sensor, generally “dumb” objects so far. In some cases, the edge will filter out the noise and only send the most relevant data to the cloud, to reduce processing and costs; in other cases, some decisions will be made locally, leading to actions. All of this generally involves machine learning and AI being performed locally.

In addition to startups doing interesting work on edge computing and analytics (Foghorn, Mythic, etc.), edge computing was embraced by tech giants in a major way over the last year or so. Since our 2016 landscape, AWS launched Greengrass; Microsoft launched Azure IoT Edge; Dell announced a $1B investment in the space; Edge X Founder, a major new open source project, backed by over 50 contributors including Dell, was also launched in the Spring of 2017.

Conclusion

The last year or so may have seen a lot of well-publicized failures of consumer IoT startups, but those should not distract from the broader story: with the acceleration of AI technology, key progress on the connectivity front and the emergence of specialized IoT offerings from all major cloud providers, the fundamental pieces of infrastructure needed for the Internet of Things to succeed are gradually falling in place. Much work remains to be done in key areas such as security.

A key characteristic of major new technology waves is to appear “gradually, then suddenly“. The various segments that make the Internet of Things will continue to evolve somewhat separately with their own dynamics, but as the core foundation continues to be put in place, we may soon find ourselves in a phase of exponential acceleration towards a globally connected physical world.

Every month, we host many of the best CEOs, CTOs and founders in this space at our Hardwired NYC event. If you’re in town, please come join us! Otherwise, you can see all videos of previous events on our YouTube Channel here.

____________________

METHODOLOGY & NOTES:

1) This year more than ever, we couldn’t possibly fit all companies we wanted on the chart. While the general philosophy of the chart is to be as inclusive as possible, we ended up having to be somewhat selective. Our methodology is certainly imperfect, but in a nutshell, here are the main criteria:

- Everything being equal, we gave priority to startups that have reached some level of market significance. This is a reasonably easy exercise for large tech companies. For growing startups, considering the limited amounts of data available, we often used venture capital financings as a proxy for underlying market traction (again, probably imperfect). So everything else being equal, we tend to feature startups that have raised larger amounts, typically Series A and beyond.

- Occasionally, we made editorial decisions to include earlier stage startups when we thought they were particularly interesting.

- This year as in previous years, we removed a number of companies (95). One key reason for removal is that the company was acquired, and not run by the acquirer as an independent company.. In some select cases, we left the acquired company as is in the chart when we felt that the brand would be preserved as a reasonably separate offering from that of the acquiring company.

2) As always, it is inevitable that we inadvertently missed some great companies in the process of putting this chart together. Did we miss yours? Feel free to add thoughts and suggestions in the comments.

3) The chart is in png format, which should preserve overall quality when zooming, etc.

4) Feel free to use the chart in books, conferences, presentations, etc – two obvious asks: (i) do not alter/edit the chart and (ii) please provide clear attribution (Matt Turck, Demi Obayomi and FirstMark Capital).

5) Disclaimer: FirstMark is an investor several companies mentioned on this IoT landscape, including: Helium, Kinsa, Optimus Ride, Starry, ROLI, Sketchfab and a couple of other unannounced.

6) Thank you: Nate Williams for reviewing an early draft of the landscape and my FirstMark colleagues Dan Kozikowski and Liz Mead for reviewing the post.

Thanks for the great update and illuminating commentary!

Quick question: How many companies of your IoT landscape are VC Unicorns? Or, how many of the VC Unicorns have a significant IoT focus/component?

I don’t have any tools to compare the two lists, but since you mentioned the size of Peloton’s funding I checked and they are indeed a VC Unicorn.

I did a search of the VC Unicorn list for “IoT” but only found one, C3 IoT, which is on your landscape list. Peloton is not marked as IoT on the VC Unicorn list.

Both companies are new to the VC Unicorn list in 2017.

Any other IoT Unicorns besides those two?

Any forecast or expectations for how many IoT’s will become Unicorns in 2018?

Any idea how many IoT’s are VC Centaurs? Or forecast as Centaurs in 2018?

It’s a really good question, we should run the analysis. There are certainly others, like Uptake and some companies in the autonomous vehicle category. Also many of the Softbank Vision Fund financings were presumably done at unicorn or near-unicorn valuation levels, considering the round sizes. Having said that, in general any company with a strong hardware component tends to face a much slower road to high VC valuations (which are generally a reflection of investors willing to bet that the company will scale massively, and it’s harder and takes longer for a hardware company to scale massively). Of course, as we all know, the “unicorn” status is largely fictional (all on paper, until an actual exit occurs), and no guarantee of eventual success.

Great job on the IoT landscape presentation.

FYI, our company, Semios, is one of the largest IoT solutions in Ag with over 150,000 sensors reporting every 10 min on our proprietary wireless network. Our focus is on helping growers of tree fruits, nuts and grapes manage risk from pests, disease, drought and frost.

Thanks for the kind words and putting Semios on our radar, Michael.

I don’t think the Landscape graphic is accurate. The sensors provider does not list major ones such as Analog Devices Inc. , Libelium, Honeywell, Bosch etc.

Thanks for the feedback. We’ll add those to the next version.

Really, almost 75% of IoT projects fail.

for that need to do proper market study and analysis…

That Cisco study was certainly disputed across the industry, pretty controversial. But it is directionally interesting.

Nice article. Good information about the IoT landscape.

We, Gambit Communications, have a IoT Simulator tool for doing POC and testing of IoT applications and platforms. It creates a large network of thousands of IoT sensors and devices from different vendors. Each of them with different types, traffic patterns and IP address.

Thanks for putting the company on our radar, Pankaj.

Awesome post Matt! Though consumer IoT and IoT in general was 2017 was muted from a press and exit perspective, a lot of exciting things are happening away from the limelight. We’ve seen really exciting growth in both adoption and diversity of use cases on IFTTT and we expect that to accelerate in 2018. As an industry we have to keep making EVERYTHING easier, from UX to the language we use. It may actually be a great thing if we all stopped talking about IoT in 2018 and began to acknowledge that the internet and internet services are becoming a part of every single thing we do, use and own. Great post!

Thanks Linden! Yes, fully agree. There are still a number of challenges and opportunities that are specific enough to the Internet of Things, but soon enough the IoT will disappear as a category because the normal state of affairs will be for everything to be connected. The fate of major technology evolutions is often to disappear in the background as they become ubiquitous.

While I’m glad to see one of the Open Source Home automation platforms on there (i.e. OpenHAB) the other two Open Source Home automation options seem to be missing: HAss (Home-Assistant.io) and Domoticz.

Also missing, Espressif Systems (http://espressif.com/) maker of the esp8266, esp32 and variants in a surprising percentage of WiFi connected devices. As their homepage says, they’ve shipped over 100,000,000 devices.

Yes, i am surprised by the lack of Espressif Systems on the list. they have a very competitive chip solutions and have been a clear favorite among hobbyists and professionals as well.

Hi Matt – Great post. Please add Software AG to your radar under the full stack horizontal software platform category. We’ve recently acquired Cumulocity, which gives us fully agnostic device connectivity and management, coupled with Software AG’s leading Apama streaming analytics, webMethods hybrid integration, Terracotta in-memory DB and ARIS business process management. We have many customers across the verticals and have connected to millions of devices. http://softwareag.com/iot

This is a great job by your Matt, Demi and First Mark. “Aeris” on your list is listed as Platform under Section “Connectivity”. Aeris Communications offers both platform for connectivity mgmt, device mgmt and application enablement and as well we provide solutions in domain of automotive, fleet mgmt, healthcare, employee tracking, insurance and others. Can you please kindly update it in your database ?

Another observation: You mentioned that IoT was mostly mentioned under context of AI/ML in 2017, that’s fair inference and I also think “BlockChain” is another context under which IoT was referenced a lot.

Thanks Vinay. We try as much as possible to keep it to one category per company, except for the tech giants (like Amazon/AWS). Otherwise this chart would simply be impossible to put on one single page, as many companies have solutions in several industries. Thanks for the comment on blockchain — there’s a whole section in the post on the topic (“The IoT, now with blockchain”).