It’s been an exciting, but complex year in the data world.

Just as last year, the data tech ecosystem has continued to “fire on all cylinders”. If nothing else, data is probably even more front and center in 2018, in both business and personal conversations. Some of the reasons, however, have changed.

On the one hand, data technologies (Big Data, data science, machine learning, AI) continue their march forward, becoming ever more efficient, and also more widely adopted in businesses around the world. It is no accident that one of the key themes in the corporate world in 2018 so far has been “digital transformation”. The term may feel quaint to some (“isn’t that what’s been happening for the last 25 years?”), but it reflects that many of the more traditional industries and companies are now fully engaged into their journey to become truly data-driven.

On the other hand, a much broader cross-section of the public has become aware of the pitfalls of data. Whether it is through the very public debate over the risks of AI, the Cambridge Analytica scandal, the massive Equifax data breach, GDPR-related privacy discussions or reports of growing government surveillance in China, the data world has started revealing some darker, scarier undertones.

Both are the flipside of the same phenomenon, which has been brewing for many years but is now in full display: just about everything (whether personal or professional) is rapidly getting digitized, and data technologies are becoming more adept than ever at processing and analyzing this massive data exhaust, increasingly in real time. From this can result both magic and abuse. The debate on how to combine this great power with a necessary sense of responsibility has become essential.

Let’s highlight some of the key trends and events of 2018.

Infrastructure & Analytics

From an industry standpoint, the data ecosystem remains as exciting and vibrant as ever, with a rich tapestry of innovative startups, mature “scale-ups”, and many aggressive public technology vendors. Most importantly, many customers large and small are deploying those technologies in production at scale, and reaping undeniable value from their efforts.

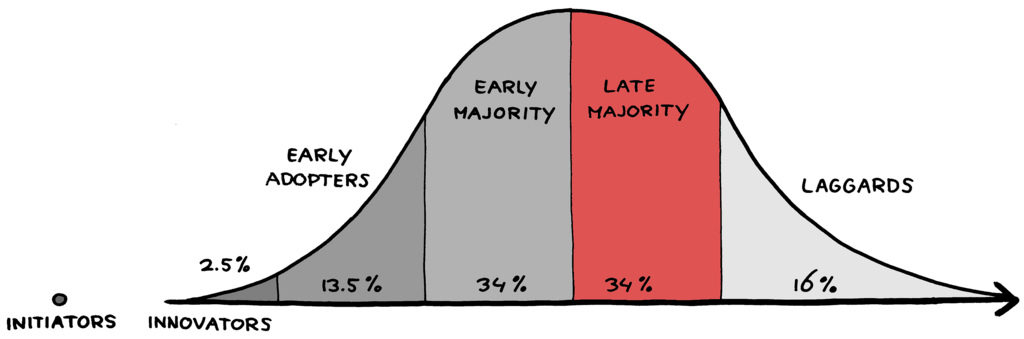

As the cycle of replacing older IT technologies with more modern data products continues, it seems that the Big Data market (infrastructure, analytics) is cycling through the early majority of buyers and transitioning into the late majority of the traditional adoption curve.

In addition, the data world continues its inexorable evolution towards the cloud. It is actually staggering to see how fast the large public cloud providers (AWS, Azure, Google Cloud Platform, IBM) are growing, considering they already each generate billions of dollars of revenues every quarter. The trend raises ongoing concerns around vendor lock-in, and this may open up opportunities for startups offering multi-cloud solutions. However, to date even companies adopting multi-cloud strategies tend to still rely on one vendor as their primary provider.

As they keep growing, large cloud providers increasingly compete with each other by offering a wide array of Big Data, data engineering and machine learning tools through their platforms (e.g., Amazon Neptune, Google AutoML, etc.) – and often with aggressive pricing, to attract more developers, as their true business model is data storage. As the scope and sophistication of such tools keep growing, this has a big impact on the data technology landscape, making it arguably harder for startups to compete, at least for broad, horizontal opportunities. A bit more every year, the list of product announcements at big annual cloud vendor conferences (see AWS re:Invent, for example) sends shockwaves in the startup industry, as they put cloud vendors in direct competition with dozens of VC-backed startups in one fell swoop. It will be interesting to see how public markets react to the upcoming Elastic IPO, an open-source software company that saw Amazon launch a direct competitor, Elasticsearch, three years ago.

Plenty of opportunities for startups remain, however, as long as they are sufficiently differentiated. Many in the space are scaling fast, and there are a number of particularly interesting, fast-growing segments in the infrastructure and analytics part of the ecosystem, including streaming/real-time, data governance, and data fabrics/virtualization. The explosion of interest in AI has also led to great opportunities (and a lot of funding) in AI chips, GPU databases, AI devops tools, and platforms enabling the deployment of data science and machine learning in the enterprise.

Machine Learning & AI

It’s certainly been a wild year in the world of AI research, with anything from the prowess of AlphaZero to the staggering pace of release of new advances – new forms of Generative Adversarial Networks, Vicarious’ new Recursive Cortical Networks, Geoff Hinton’s new Capsule Networks. AI conferences like NIPS have grown to attract 8,000 people and thousands of academic papers are being submitted every day.

At the same time, the pursuit of AGI remains elusive, perhaps thankfully so. Much of the current wave of excitement (and fear) about AI results from the impressive performance of deep learning since 2012 but, in the AI research community, there’s a growing sense of “what now?” as some question the foundations of deep learning (backpropagation) and others look to move past what they consider “brute force” approaches (lots of data, lots of computing power), perhaps in favor of more neuroscience-based approaches.

Far from fearing robot world domination, many in the AI research community are concerned that continued over-hyping of the field may eventually disappoint and lead to another AI nuclear winter.

Outside of AI research, however, we are just at the beginning of a wave of deployment and application of deep learning in the real world across a variety of problems involving speech recognition, image classification, object recognition and language, in different industries. If the infrastructure and analytics part of the ecosystem is getting to the late majority, we’re still very much in early adopter territory for enterprise and vertical AI applications.

The Cambrian explosion of deep-learning based startups that started a year or two ago has mostly continued unabated, even though the AI startup market is (arguably) showing signs of finally cooling down. Expectations, round sizes and valuations remain high, but we are certainly past the phase where big Internet companies would snap up very early AI startups at high prices just for the talent. The air is also clearing up a bit and revealing “real” AI startups, versus a number of other companies that were leveraging the hype. Some of the AI startups that were founded in the 2014-2016 time frame are starting to hit early scale, and many are offering increasingly interesting products across industries and verticals including health, finance, “industry 4.0” and back office automation. Deep learning will continue bringing a lot of value in real world applications for years to come, and vertical-focused AI startups have many great opportunities ahead of them.

This continued explosion is very much a global phenomenon, with Canada, France, Germany, the U.K. and Israel being particularly active. However, China seems to be playing at a completely different level in AI, with reports of government-led pooling of data at mind-boggling scale (across Internet companies and municipalities), rapid advances in areas such as facial recognition and AI chips, and gigantic rounds of financing for its startups: according to CB Insights, China accounted for only 9% of global AI deal share but nearly 48% of global AI funding in 2017, up from 11% in 2016 (see some examples below).

In the same vein, issues of data privacy (and ownership and security) are emerging as a major concern around the world. In the early days of the Internet, data privacy was about protecting what we did online, a comparatively small portion of our activities. Correspondingly, only a small (albeit vocal and passionate) minority of people truly cared. As just about every aspect of our personal and professional lives is now connected to the Internet through an ever increasing array of connected devices, the stakes are changing. With its ability to spot anomalies in massive data sets, predict outcomes and recognize faces, AI is compounding the data privacy problem.

A separate but related concern is that a lot of this data is owned by large Internet companies (GAFA). Some, like Facebook, have proven to be a less than perfect steward of it. Nonetheless, this data provides them an unfair advantage in the race to produce ever more powerful AI.

Against those issues, an emerging theme is to think of the blockchain as a possible foil against the risks of AI, as well as a way for others, outside of GAFA, to produce great AI. Crypto economics are viewed as a way to incentivize individuals to provide their personal data and for machine learning engineers to build models by processing this data anonymously. It all remains very experimental, but some early marketplaces and networks are emerging

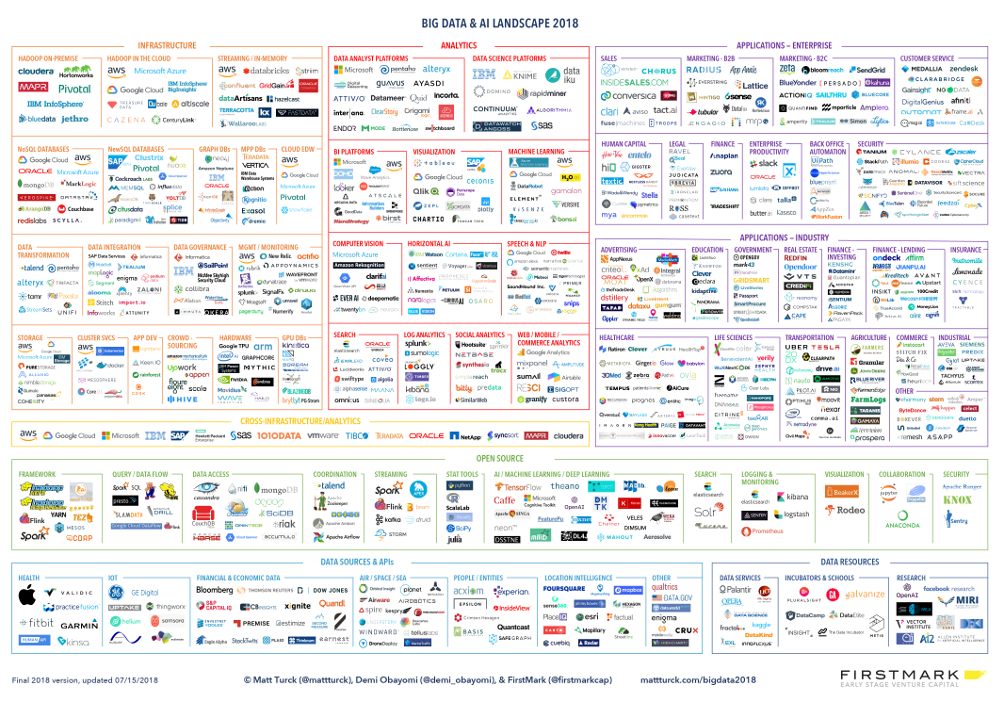

The 2018 Landscape

Without further ado, here’s our 2018 landscape.

Quite semantic note: buzz terms come and go. Fewer people speak about “Big Data”, many more about “AI”, often to described the same reality. Consequently, we have slightly rebranded our 2018 landscape: it is now called the “Big Data & AI” landscape!

To see the landscape at full size, click here.

(The image is high-res and should lend itself to zooming in well, including on mobile)

To download the full-size image, click here.

To view a full list of companies in spreadsheet format, click here.

This year, my FirstMark colleague Demi Obayomi provided immense help with the landscape.

We’ve detailed some of our methodology in the notes to this post. Thoughts and suggestions welcome – please use the comment section to this post.

Who’s in, who’s out

On the exit front, the last year (since our 2017 landscape) has seen solid, but not extraordinarily strong.

A few key companies appearing on the landscape went public, in particular Cloudera, MongoDB Pivotal and Zuora. Others are preparing to go out at the time of this writing, such as Elastic.

Some notable acquisitions also occurred, including in particular Mulesoft (acquired by Salesforce post-IPO, for $6.5B), Flatiron Health (acquired by Roched for $2.1B), Appnexus (acquired by AT&T for $1.6B), Syncsort and Vision Solutions (acquired for $1.2B by Centerbridge Partners), Moat (acquired by Oracle for $850M), Integral Ad Science (acquired by Vista Equity Partners for $850M), eVestment (acquired by NASDAQ for $705M) and Kensho (acquired by S&P Global for $550M). It is worth noting that, other than Mulesoft, all those companies are headquartered on the East Coast (New York, Boston and Atlanta).

Many other companies were also acquired for smaller amounts: Gigya (SAP), Blue River Technology (Deere & Co), CoreOS (Red Hat), Guavus (Thales), Lattice Data (Apple), Socrata (Tyler Technologies) and PracticeFusion (AllScripts).

On the investment front, this was a year of big financing rounds for some Big Data and AI startups, particularly in China, with a number of oversized investments including Bytedance ($3B in total across 2 rounds in 2017), NIO ($1.6B across two rounds in 2017), and SenseTime ($850M across two around in 2017 and 2018).

Major rounds of US companies appearing on the landscape include Snowflake Computing ($263M Series A – see our recent fireside chat at Data Driven NYC), Cohesity ($250M Series D), Dataminr ($221M Series E), Affirm ($200M Series E), Rubrik ($180M Series D), Qualtrics ($180M Series C – see an older but still relevant fireside chat at Data Driven NYC), Tanium ($180M private equity round), ThoughtSpot ($145M Series D) and Coveo ($100M private equity round) and C3IoT ($100M Series F).

____________________

NOTES:

1) As every year, we couldn’t possibly fit all companies we wanted on the chart. While the general philosophy of the chart is to be as inclusive as possible, we ended up having to be somewhat selective. Our methodology is certainly imperfect, but in a nutshell, here are the main criteria:

- Everything being equal, we gave priority to companies that have reached some level of market significance. This is a reasonably easy exercise for large tech companies. For growing startups, considering the limited amounts of data available, we often used venture capital financings as a proxy for underlying market traction (again, probably imperfect). So everything else being equal, we tend to feature startups that have raised larger amounts, typically Series A and beyond.

- Occasionally, we made editorial decisions to include earlier stage startups when we thought they were particularly interesting.

- On the application front, we gave priority to companies that explicitly leverage Big Data, machine learning and AI as a key component or differentiator of their offering. As discussed in the piece, it is a tricky exercise at a time when companies are increasingly crafting their marketing around an AI message, but we did our best.

- This year as in previous years, we removed a number of companies. One key reason for removal is that the company was acquired, and not run by the acquirer as an independent company.. In some select cases, we left the acquired company as is in the chart when we felt that the brand would be preserved as a reasonably separate offering from that of the acquiring company.

2) As always, it is inevitable that we inadvertently missed some great companies in the process of putting this chart together. Did we miss yours? Feel free to add thoughts and suggestions in the comments.

3) The chart is in png format, which should preserve overall quality when zooming, including on mobile.

4) As we get a lot of requests every year: feel free to use the chart in books, conferences, presentations, etc – two obvious asks: (i) do not alter/edit the chart and (ii) please provide clear attribution (Matt Turck, Demi Obayomi and FirstMark Capital).

5) Disclaimer: I’m an investor through FirstMark in a number of companies mentioned on this Big Data Landscape, specifically: ActionIQ, Cockroach Labs, Dataiku, Frame.ai, Helium, HyperScience, Kinsa, Timber, Sense360 and x.ai. Other FirstMark portfolio companies mentioned on this chart include Bluecore, Engagio, HowGood, Payoff, Knewton, Insikt, Optimus Ride, and Tubular. I’m a small personal shareholder in Datadog.

hi Matt, I have been a huge fan of you and your blog since I first attended your DataDriven NYC at Bloomberg NYC HQ a couple years ago and the articles you wrote are incredibly insightful. I’m just wondering whether it is possible that I could have the permission to translate yours into Chinese and share w/ additional audience? In US alone, there are many Chinese living and working here and many of them are either interested or already into the startup world. Your articles would provide a lot of values.

*I recently moved back to China for startups and just started translating great articles on personal spare time.

My email is LYCHEN333@gmail.com, look forward to hearing back from you. Thank you!

Yes, feel free! Obviously, just give proper attribution (me, Demi, FirstMark). Thank you.

yes, of course I will do. Again, thanks!

DataTorrent is listed under ‘Infrastruce -> Streaming, In-Memory’ . This startup founded in 2012 was shut down at the end of May 2018. Reference:

https://www.datanami.com/2018/05/08/datatorrent-stream-processing-startup-folds/

Ah, good catch! Thank you.

I appreciate your work on Data Science. It’s such a wonderful read on Data Science course. Keep sharing stuffs like this. I am also educating people on similar Data Science training so if you are interested to know more you can watch this Data Science tutorial:-https://www.youtube.com/watch?v=1ek7IdGhbXI

Flink should be under ‘dataflow’. It is currently the only non-cloud option for implementing dataflow.

Noted, appreciate the input.

Hey Matt,

You have MapR listed under “Hadoop – on-premises”. But, Hadoop is just one workload. MapR supports many. For instance, native noSQL databases and message queuing. And HPC. And directly support for AI/ML programs that never heard of Hadoop. And postgres, mysql, sybase, vertica and Hana all run natively on MapR.

So, really, putting MapR in just one square under Hadoop is pretty misleading / inaccurate.

Hey Ted, thanks for the input. What other boxes would you put MapR in? One solution could be to add you guys to ‘cross infrastructure and analytics” which is meant to capture vendors that are hard to fit into just one or two boxes.

Really great job with this! The illustration is amazing and really shows the complexity of the market today. Schneider Electric has recently merged their core industrial software assets into AVEVA creating one of the worlds largest industrial software companies in the world. We help our customers digitally transform their businesses across the operational and asset life cycles. We are a market leader in IIoT and predictive analytics and certainly would like to be included in future updates. Thank you.

“It will be interesting to see how public markets react to the upcoming Elastic IPO, an open-source software company [sic] that saw Amazon launch a direct competitor, Elasticsearch, three years ago*.”

Elasticsearch is built by Elastic. Check your facts.

https://aws.amazon.com/elasticsearch-service/

“It is actually staggering to see how fast the large public cloud providers (AWS, Azure, Google Cloud Platform, IBM) are growing, considering they already each generate billions of dollars of revenues every quarter. ”

It is worth mentioning that the order now is (AWS, Azure, Google Cloud Platform, Alibaba) according to this article published in June 25th 2018: Alibaba passes IBM in cloud computing and is winning business from European and US clients

https://www.cnbc.com/2018/06/25/alibaba-passes-ibm-in-public-cloud-market-share-synergy.html

Hi Matt,

Thank you for this article!

I would like to suggest adding Toucan Toco to the Visualization category.

I think that the company has shown its worth both in terms of the number of Fortune 500 clients it has and the success of its solution (Toucan’s self-funded, profitable and is expanding internationally, notably in the US).

Despite positioning itself in the “Data Storytelling” category – which adds the narrative aspect to Data Visualization – I still think that it deserves to be exposed.

I’d love your feedback.

Thanks – yes I’m familiar with you guys and happy to add you. We’ll upload a revised and final version to this post in the next few days.

Great! Thanks!

We just published the revised and final version of the chart and you’re included.

Hi Matt,

Thanks a lot for your article and for this comprehensive mapping. We at Prevision.io would love joining the landscape!

Indeed, we help companies accelerate and deploy their data science projects through an automated machine learning platform.

Feel free to reach out if you’d like further information, I’d be happy to have a chat with you.

Best,

Mickael

Hi,

Where can I find an explanation of the different categories and sub-categories?

Thanks!

Hi, Matt.

Thanks a lot for your amazing work. Could you share the reasons why Python was not included as an open source AI tool? It appears only in Stats, but with the Scikit I was expecting to see it also in AI.

Best Regards.

Hi Matt – this is a great chart and article! I would like to suggest adding Appen to the crowdsourcing category. We’ve been in business for over 20 years and work on large scale machine learning initiatives. Happy to tell you more if you want to connect. Thanks!

MAVRX (in agriculture) was shut down in May (assets acquired by Taranis). Both Taranis and Gamaya are major players in AI-based AgTech.

Thanks for the note, appreciate it.

Hi Matt, I am working for a humanitarian organization that is actually working with Palantir Phylantropy (pro-bono) team. Despite all the good work, for obvious reasons related to continues scrutiny and internal risk management, we want to find alternatives (not replace) to the platform. As far as I know there isn’t really a platform like Palantir , but we could integrate a different number of systems/tools that will provide a very similar service, or go for specialized analytics companies like Flowminder or Developmentseed. I’d very much welcome your thoughts and anyone else’s in this forum. Best

Jesus, We have a very powerful platform that is used by a number of NGOs for web data sourcing. From there we can help integrate the data into a number of partner analytics platforms. Get in touch at http://www.sequentum.com, we would be glad to help!

Hi Matt,

Well done, Interesting article!

I might add another group of products- data pipelines, very similar concept to ETL with the focus of external sources. In this group I recommend you to validate our product – Rivery.io

Good luck!

Not sure a comment I posted yesterday has been included in the threat. I was asking if anyone can recommend alternatives to Palantir Foundry solution?

Hi Matt,

it’s an interesting article, I really liked it. Thank you and Demi Obayomi for the new landscape.

If you have time, I recommend you to try out AnswerMiner (www.answerminer.com). It’s an exploration tool for data analysis with some visualization. The main strength of the tool is the prediction tree. It automatically builds a decision tree for your target value.

Once more, thank for your article.

Thank you, we will take a look!

Matt,

Appreciate the service you are providing to the big data community by cataloging the ever growing landscape. One of the newer companies in this space is one that I co-founded which spun out of Pivotal and is funded by Pivotal, GE and GTD Capital. SnappyData fuses a low latency, highly available in-memory transactional database (GemFire) into Spark with shared memory management and several optimizations that deliver performance and concurrency for mixed workloads. And most importantly, the product is GA and is being used in production by some of the largest companies in the Fortune 30 list. Do take a look at snappydata.io. You will find that we fit into more than one category in your landscape. Reach out to me and I can provide you with our high recall iconic logo 🙂

Thanks for the note Suds — the company is now on our radar for future versions.

Great post dear. It definitely has increased my knowledge on Data Science. Please keep sharing similar write ups of yours. You can check this too for Data Science tutorial as i have recorded this recently on Data Science. and i’m sure it will be helpful to you.https://www.youtube.com/watch?v=8gFu30KW-ek&t=270s

Out of interest why were DeepMind/Google Brain/Microsoft Research omitted? Deepmind is at the forefront of AI research.

Dataquest seems missing under “Educator/schools”