I spend a lot of time thinking about hype cycles, across industries (Big Data/AI, IoT) and ecosystems (New York).

Whether you use the Carlota Perez surge cycle (see this great Fred Wilson post) or the Gartner version, hype cycles convey the fundamental idea that technology markets don’t develop linearly, but instead go through phases of boom and bust before they reach wide adoption.

Hype cycles are a great framework for investors (and founders), because entering the market at the right time is both crucial and very hard.

Everything else being equal, you’d want to invest after the crash, early in the “deployment cycle” (Perez) or the “slope of enlightenment” (Gartner), when competition is comparatively limited but the market shows early signs of actual adoption. Easier said than done of course, because it is exactly the moment when things look the most uncertain. Investing right before the crash, in comparison, may seem foolish with 20/20 hindsight, but feels a lot better at the time, as one gets a lot of external validation (press, markups).

Recently, hype cycles have become even harder to decipher and “time” correctly. They’re much faster, with the time between boom and bust going from years to mere months. They’re also more pronounced, with sharper spikes that feel like instant bubbles. As soon as a category shows early signs of promise, founding activity accelerates dramatically and investor money flows in very rapidly. After just a few months, the space feels over-crowded and every investor interested in it has “made their bet”. The category then goes cold quickly, and everyone moves on to the next shiny object. Occasionally, you see a category going through a series of mini-hype cycles, with quick ups and downs.

If you think about what has got VCs (and founders) excited about the last few years, all cycles have been very short. On-demand, online lending, food, consumer IoT, VR, drones, bots, AR: they were all the rage for a bit. Fast forward to today, and it is generally difficult to get companies in those spaces financed. Deep learning, vertical farming and autonomous vehicles could very well be next in line.

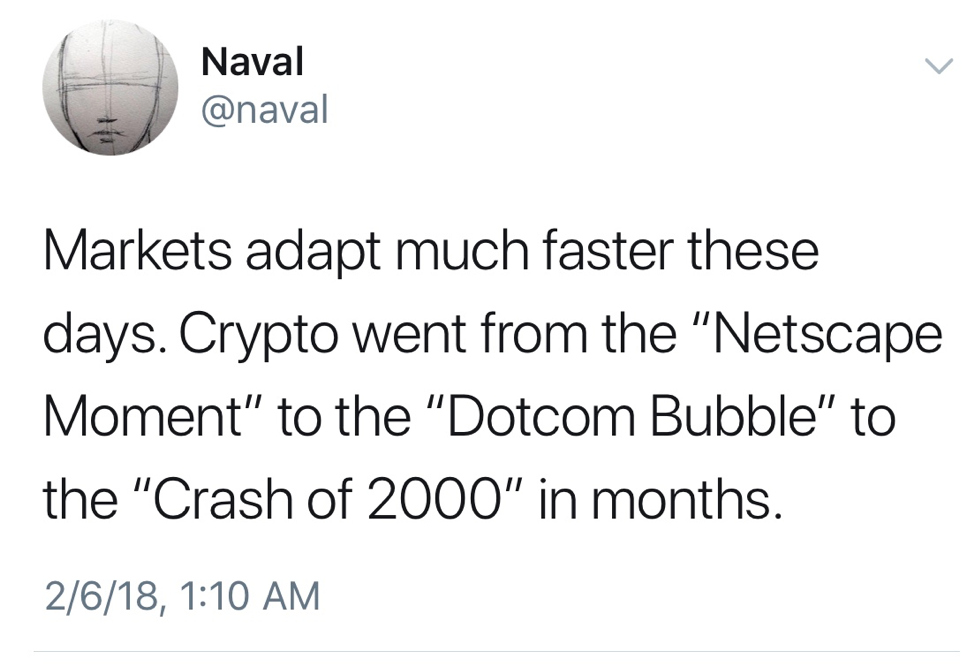

As to crypto, the current industry darling, it seems to have already gone through several booms and busts (just blips as part of a broader hype cycle, true believers will say). Naval Ravikant nicely captured the velocity of the latest gyrations (for cryptocurrencies and the underlying blockchain ecosystem) in this recent tweet:

The reasons for this compression of the hype cycle are not hard to figure out. We live in a hyperconnected world, where everyone around the globe now reads the same press and social feeds in real time. Previous waves of innovation (social networking, mobile) have subsided, and investors are anxious to find the next big thing. The system is flush with money, with billion dollar early stage funds and multi-billion dollar late stage funds with “kingmaker” strategies. A lot of it is related to a very favorable macro environment with low interest rates and a long bull cycle over the last few years (if not the last couple of weeks).

From a founder perspective, the compression of the hype cycle reinforces the temptation to raise as much money as possible during the boom phase of the cycle, in part because the bust may follow pretty quickly. Raising more money at a higher valuation will certainly expose you to the post money trap, but it may be rational behavior from entrepreneurs if you think about it as “insurance” against a quick cooling down of the market.

From an investor perspective, a shorter cycle compresses the window during which one can be “contrarian and right”. A great playbook would involve showing up very early (but not too early) in a space before it is too obvious; picking some early winners and working hand-in-hand with the founders to find the right balance between growing and conserving cash; reducing new investment pace as too much fast-follower money pours into the space; waiting for the inevitable bust; then slowly but decisively re-engaging early after the crash. Not easy!

From a system perspective, quick booms and busts are probably not the best environment for long term technological progress. As a lot of the current emerging areas involve a “deep tech” component, there’s a brutal asymmetry between how quickly markets move on and the time it takes to actually build a great company.

Perhaps one positive effect is that, as one area gets hot and the previous one gets cold (or colder), the crowd that was excited about the latter for the wrong reasons also moves on, leaving the true fans to focus on their work. An AI entrepreneur friend of mine was recently remarking that “the best thing about crypto is that many of the poseurs no longer care about machine learning”.

Meme photo courtesy of… the Internet

Very interesting – would be fascinating to see some data on this. How would you go about measuring a hype cycle as it’s happening? Going to check out the Carlota Perez book you mentioned for some inspiration.

Yes, there’s probably an interesting data dive to do on the topic. Figuring out hype cycles as they’re happening is probably both a combination of data and opinion. They tend to be clear only in hindsight… For what it’s worth, one can probably guesstimate the boom and bust part of the various segments I mentioned in the post. For example, the consumer IoT boom was probably 2014-2015 (on the heels of the Nest acquisition). Probably the same for VR (on the heels of the Oculus acquisition). Food was probably 2015-2016 (and the final nail in the coffin was the Blue Apron IPO). Chat bots were just a few months in early 2016 maybe? Some of those may or may not be early in the “slope of enlightenment”…

I think the uncertainty during the hype cycle is the most thrilling part of investing. A lot of investors want high yield investments and that’s done by taking a risk and investing in companies such as Intuit stock. The true fans will always stick around.