Thomson Reuters CTO James Powell runs a great series of podcasts where he interviews people in the technology world about topics of relevance to his organization. I was fortunate to be invited to speak with James about the Internet of Things and Big Data, and it was a lot of fun. Below is the podcast, uploaded on SoundCloud. Thanks to James Powell and Dan Cost for the opportunity.

Author: matt turck

Launching New Sites for Data Driven NYC and Hardwired NYC

Some updates on the event/community front:

1) A little while ago, I changed the name of the data event I’ve been organizing from “NYC Data Business Meetup” to “Data Driven NYC”. I originally started the event mostly as experiment, and didn’t give much thought to branding (so yeah, that was a terrible name). The event has now grown quite a bit (over 3.700 members as I write this), so it was time for a better name; also at this stage, it feels more like a community than “just” a meetup, so I wanted a name that reflected this reality.

2) Back in June, I launched a new community called “Hardwired NYC”. It covers startups, technologies and products at the intersection of the physical and digital worlds, including topics like 3D printing, Internet of Things, wearable computing, etc. I developed a strong interest in those areas through my involvement in the Big Data world – the Internet of Things, in particular, is deeply intertwined with Big Data (the proliferation of sensors has been contributing to the Big Data “problem”; equally the Internet of Things will be highly dependent on Big Data technologies if it is to deliver on its promise).

3) As Hardwired NYC is taking off fast (more than 700 members after just two events), I figured that both events/communities should have their own website with full video libraries, including for people who don’t live in New York and are interested in the content. So, with the great help of my FirstMark colleague Dan Kozikowski, I’m launching this week www.datadrivennyc.com and www.hardwirednyc.com. Both sites have a “Watch” section where, from now on, I will post pictures and videos of events (as opposed to this blog).

Making Sense of the Internet of Things

Note: This post was originally published in TechCrunch a few weeks ago (see original post here). Below is a revised version of the chart, that reflects many of the comments we received. Although the chart is very full, it is likely that some companies are missing.

The emerging Internet of Things — essentially, the world of physical devices connected to the network/Internet, from your Fitbit or Nest to industrial machines — is experiencing a burst of activity and creativity that is getting entrepreneurs, VCs and the press equally excited.

The space looks like a boisterous hodgepodge of smart hobbyists, new startups and large corporations that are eager to be a part of what could be a huge market, and all sorts of enabling products and technologies, some of which, including crowdfunding and 3D printing, are themselves far from established.

The chart above is an attempt at making sense of this frenetic activity. From bottom to top, I see three broad areas – building blocks, verticals and horizontals:

Building Blocks

The concept of the Internet of Things is not new (the term itself was coined in 1999), but it is now in the process of becoming a reality thanks to the confluence of several key factors.

First, while still challenging, it is easier and cheaper than ever to produce hardware – some components are open sourced (e.g. Arduino microcontrollers); 3D printing helps with rapid prototyping; specialized providers like Dragon Innovation and PCH can handle key parts of the production process, and emerging marketplaces such as Grand St. help with distribution. Crowdfunding sites like Kickstarter or Indiegogo considerably de-risk the early phase of creating hardware by establishing market demand and providing financing.

Second, the world of wireless connectivity has dramatically evolved over the last few years. The mobile phone (or tablet), now a supercomputer in everyone’s hand, is becoming the universal remote control of the Internet of Things. Ubiquitous connectivity is becoming a reality (Wi-Fi, Bluetooth, 4G) and standards are starting to emerge (MQTT). The slight irony of the “Internet of Things” moniker is that things are often connected via M2M (machine to machine) protocols rather than the Internet itself.

Third, the Internet of Things is able to leverage an entire infrastructure that has emerged in related areas. Cloud computing enables the creation of “dumb” (simpler, cheaper) devices, with all the intelligence processed in the cloud. Big data tools, often open sourced (Hadoop), enable the processing of massive amounts of data captured by the devices and will play a crucial role in the space.

Verticals

Unlike the Big Data space, where the action is gradually moving from core infrastructure to vertical applications, the Internet of Things space is seeing a lot of early action directly at the vertical application level. Some notable players like Nest Labs seem to have adopted a deeply integrated vertical strategy where they control key pieces of the product, including both hardware and software, in order to have complete control over the end-user experience (a lot like Apple, which is not surprising considering the founders’ background).

Beyond the Nest, home automation in general has become the central battlefield of the Internet of Things, with some of the most exciting startups in the space jockeying for position. Another hot consumer-facing area is obviously quantified self, which is playing a huge role in developing consumers’ awareness of the potential of the Internet of Things.

Beyond consumer, B2B/enterprise vertical applications of the Internet of Things, fueled in part by robotics, hold considerable promise in a number of areas such as manufacturing, transportation, healthcare, retail and energy. Some of clearest revenue opportunities for IoT startups are in the enterprise area.

Horizontals

While a lot of the action is happening at the vertical application level, the ultimate prize for many ambitious players in the space is to become the software platform upon which all vertical applications in the Internet of Things will be built. For example, several of the home automation providers (SmartThings, Ninja Blocks, etc.) also provide a software platform, and seem to be leveraging their vertical focus as a way to kickstart activity on the platform.

Large corporations (GE, IBM, etc.) are very active in the space and are developing their own platforms. Carriers (AT&T, Verizon) have a large opportunity in the area, as well.

One open question is whether a platform developed for a vertical will easily translate to another vertical. In addition, whether the winning platforms are open or closed will play a huge role in the future of the space. My bet would be on openness.

The related area of connectivity (connecting objects to the network/Internet and to one another through all sorts of rules) is also a very significant opportunity.

The space is extraordinarily exciting, but still very much in its infancy – expect this chart to change dramatically over the next few months and years.

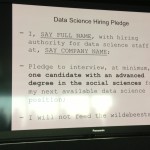

Data Driven NYC: Special Data Science

The May edition of Data Driven NYC (f/k/a NYC Data Business Meetup) featured some of the coolest kids of the Data Science world, in NYC and beyond:

* Cathy O’Neil, Senior Data Scientist at Johnson Research Labs

* Claudia Perlich, Chief Scientist at M6D

* Drew Conway, Scientist-in-Residence at IA Ventures

* Chris Wiggins, Professor at Columbia University and co-founder of HackNY

* Max Shron – Data strategy consultant and former data scientist at OkCupid

Unfortunately, no videos for Cathy and Claudia – their microphones did not work. I didn’t include the panel video either because large chunks of it are silent (due to the same issues with Cathy’s and Claudia’s microphones). Bummer.

Chris Wiggins:

Drew Conway:

Internet of Things Meetup

At the April #NYDBM, we explored the fascinating intersection between Big Data and the Internet of Things.

One of the reasons why volumes of data have been escalating prodigiously over the last few years has been the proliferation of sensors of all kinds (in cell phones, cars, industrial plants, etc.), providing a unique articulation between the online and physical worlds. The concept of an Internet of Things (and its cousin for the manufacturing world, the “Industrial Internet”), where objects, devices and machines are connected and operable through a network, is not a new concept, but it is now quickly accelerating. In the Internet of Things, all objects become represented by data, and the intelligence is pushed above the level of the devices themselves, to the cloud where big data technologies help operate the devices with new levels of efficiency, factoring in not just the individual circumstances of that specific device but also those of connected devices as well as the external context affecting the network at any point in time.

We started with a few spotlight presentations by three pre-funding startups in the space:

- Canary (fka ForceField Labs): Connected device for home security and monitoring

- Placemeter: Smart in-store sensors capturing customer data(part of the current Techstars NYC class)

- Dash Labs: Connected car platform (also part of current Techstars NYC class)

We then featured the following speakers:

- Alex Hawkinson, CEO, SmartThings

- Peter Semmelhack, CEO, Bug Labs and author of a new book, “Social Machines”

- Jon Bruner, data journalist at O’Reilly and author of a new report on “The Industrial Internet”

- Steve Schlafman of Lerer Ventures

- Phin Barnes of First Round Capital

Canary:

Placemeter:

Dash:

Peter Semmelhack:

Jon Bruner:

SmartThings:

Panel:

Cloudera, Greylock, Platfora and Think Big Analytics

We had an all star event on March 19 at the New York Data Business Meetup with some great presentations and discussions (and some fun stuff as well: see Jeff Hammerbacher’s first few slides about how the term “data scientist” came to existence).

Many thanks to the people who made it possible:

– Silvio Galea and Annie Dane for hosting us at the very cool WeWork space in SoHo

– David Raviv for doing amazing work with the videos

– Shivon Zilis for taking great pics and being all around super helfpul and resourceful

Here are the videos, in order of appearance:

And here are some pics:

Big Data 101 Presentation

A few weeks ago, I was invited to do a couple of guest lectures at NYU (as part of the excellent “Ready, Fire, Aim” entrepreneurship class that Lawrence Lenihan, now my partner at FirstMark, has been doing for a while there) and at The New School (as part of a Big Data course organized by Debra Anderson and Greta Knutzen). Thought I’d share the slide deck I had prepared for those classes. Very much a Big Data 101 class for a college-level audience that had had little or no exposure to the key concepts prior to the class.

Joining FirstMark Capital

Today I’m very excited to announce that I’m joining FirstMark Capital as Managing Director. My main investment focus will be on areas that correspond to my professional background (B2B, enterprise, Big Data, fintech, education, etc.), but I will also happily be open to any big idea involving technology.

As anyone who follows the venture capital industry knows, opportunities of this nature and quality don’t come by very often, and I’m incredibly grateful and honored by the trust that the FirstMark team has placed in me.

At a time when venture capital has been facing substantial challenges and transformation, FirstMark is in my opinion a perfect example of “VC done right”, resulting in much deserved early success:

- Results: Probably in large part because FirstMark’s philosophy has been to focus the light entirely on their entrepreneurs, I don’t think people have quite caught on to just how impressive a firm FirstMark has become in the short span of five years since its creation. In many ways, FirstMark is one of the industry’s best-kept secrets: their first fund ($200 million) is one of the very best of its vintage, and the follow up fund ($225 million) has already had some real breakouts.

- Disruption & Innovation: A quick perusal through the FirstMark’s portfolio immediately tells a story of thoughtful but gutsy bets in a number of highly disruptive plays. Beyond the more visible runaway hits (first VC money in Pinterest), FirstMark has invested in companies reinventing education (Knewton), finance (SecondMarket), television (Aereo), news distribution (NewsCred), gaming (Riot Games) and… your brain (Lumosity).

- Founder/CEO Support: Perhaps the ultimate testament to FirstMark’s approach in my opinion is that the CEOs of its portfolio companies simply rave about the firm. The FirstMark team brings a tremendous amount of intelligence, hard work, experience and connections to the table, as well as a fair amount of New York-style hustle.

- Community and Portfolio Services: The venture capital model has been gradually evolving over the last few years from a capital-centric model (where VCs provide mostly funding and oversight) to a service-centric model (where money is increasingly commoditized and VCs add value by providing a suite of operational services that enable entrepreneurs and their startups to fully realize their success potential). FirstMark is one of the few funds, typically part of a new generation of VCs, that have made a true commitment to providing operational services to their portfolio companies, whether in terms of recruiting, research or knowledge sharing. In my own community-building endeavor (the monthly Big Data event I run, see below), I have experienced firsthand both the level of effort required to pull this off and the tremendous benefits one gets in return, and I was extremely impressed with the current programming and roadmap for community that FirstMark has put in place, with apparently a lot more coming.

Beyond the intrinsic qualities of the firm, perhaps the most important factor that drew me to FirstMark is the effortless personal fit I have with its partners and team. Venture capital can be a tough business, with its fair share of ego and difficult types, so it’s an extraordinary privilege to get to work with a team of highly intelligent, humble, focused, talented and overall great group of individuals.

I will certainly miss my friends at Bloomberg, a company for which I have developed a profound admiration over the years, but I couldn’t be more happy and excited about the future. I look forward to being even more active in the startup community and interacting with many of you.

For those of you in NYC who are wondering, I will still very much continue to run my Big Data meetup (the NYC Data Business Meetup) and in fact I will use the opportunity to take it to the next level over the next few months – stay tuned.

Quantopian, Plaid and ZestFinance

Our February NYC Data Business Meetup was focused on the intersection of data and finance (both market and consumer finance). Quantopian, Plaid and ZestFinance presented.

We also had a great panel presenting the customer perspective on Big Data (hype vs. reality), from a financial institutions’ viewpoint, with the following speakers: Mike Simone (Global Head of CitiData Platform Engineering), Emile Werr (Head of Enterprise Data Architecture, NYSE EuroNext) and Raj Patil (up until recently Data innovation CTO at UBS, now an entrepreneur). Unfortunately, due to standard policy at some of those institutions, we can’t publicly post the video of the panel.

Here are the videos, in order of appearance (we also had a great “customer panel

Bloomberg App Portal:

Quantopian:

Plaid:

ZestFinance:

Panel:

A Guide to the Berlin Tech Ecosystem

The rise of Berlin as an entrepreneurial center is not exactly news, and a number of U.S. VC funds or angel investors have been active there for a while. My overall impression, however, is that many U.S.-based entrepreneurs and investors have only a fuzzy idea about what is going on over there, and arguably in Europe in general – a missed opportunity in my opinion, and perhaps one of the several reasons why Europe is still a largely underserved opportunity in terms of venture capital investment. The globalization of entrepreneurship has been one of the key trends in our industry. At this stage, there’s enough evidence of global success stories coming out of Europe that smart U.S. investors should be routinely investing in the area, despite the traditional issues associated with early stage investing in Europe (multiple markets, multiple languages, tax and regulatory issues, different attitudes towards risk/failure, etc.).

From that perspective, I thought it might make sense to share notes (very much in note format) from recent travel to Berlin (among other reasons to speak at Data Days, a fun event) and a number of conversations with Berlin-based entrepreneurs and investors in other contexts. This is meant to be a “beginner’s guide” for outsiders like me, not the ultimate reference on the topic.

Overall, there’s plenty of reasons to be excited about Berlin. While some claim that the real action has already moved on to other locations (like Istanbul), the Berlin tech ecosystem is still early, and in many ways trailing other emerging global tech centers like London and NYC, probably by a few years. The fundamentals, however, are encouraging, particularly considering that the government (very active both in London and NYC) has been largely absent from the development of the Berlin ecosystem, so pretty much everything that has been happening there so far has been driven by raw, grassroots entrepreneurial energy.

Many thanks to Christophe Maire (currently CEO of Txtr), Jess Erickson (General Assembly Berlin), Koen Lenssen (Tengelmann Ventures) and Saskia Ketz (SumAll) for reviewing this post.

Key characteristics

Unique

- Just like New York or San Francisco are not like the rest of the U.S., Berlin is not like the rest of Germany

- Artistic (buoyant contemporary art scene), rebellious culture (or “counterculture”), which seems to translate well into design talent

- Innovative and fun (renowned nightlife)

- Cheap, large apartments – particularly compared to tech centers like London, NYC or SF where finding affordable housing is an extraordinary challenge. Some say that this won’t last long if Berlin continues on its current trajectory; at the same time, the city is very large and housing supply may exceed demand for a while.

- Socially open, no class system, left leaning with an openly gay mayor (Klaus Wowereit) from the SPD (social democratic party), in power since 2001.

- Capital of one of the world’s largest economy, yet due to history, no local industry – local talent does not have many other options

- Traditional economic centers in Germany such as Munich, Frankfurt and Hamburg lag behind in terms of tech startup activity – which doesn’t mean that those cities do not have interesting companies: for example, Hamburg seems to have a gaming cluster (Bigpoint, Innogames, GoodGames, etc.), and both Facebook and Google have offices there; Munich has West Wing (online shopping club for Home & Living, received $50M of investment in June 2012), Frankfurt/Wiesdaben is active in social entrepreneurship (Hans Reitz/Grameen). But Berlin seems to have strong gravitational pull; for example, when airbnb arrived in Europe, it set up shop in Hamburg after acquiring German clone Accoleo , but subsequently moved moved all operations to Berlin. Twitter also chose Berlin over other German cities to base its operations. MTV has been there since 2004 (after moving from Munich).

Immigrant-friendly

- Part of the European Union (doesn’t solve all labor laws issues, but helps tremendously in terms of recruiting talent from other EU countries)

- Just about everybody seems to speak English

- International founders: perhaps ironically, a number of Berlin startups, including some of the most prominent ones, were founded or co-founded by non German nationals, including Souncloud (Swedish founders), Gidsy (Dutch founders), Amen (one American co-founder), Incrediblue (Greek founders), Readmill (Swedish founder), GoEuro (American), rules.io (American), GetYourGuide (Swiss), etc.

Solid supply of technical talent

- For now at least, there’s much less of a talent war than in other tech hubs, particularly SF and NYC, but some say it is changing fast.

- Strong German work ethic (one of the reasons for an overall low employee turnover, together with restrictive laws around employment termination and the German social structure in general).

- Solid universities, although fairly theoretical: Humboldt, Technical University, Freie Universiat. Berlin also has two of Germany’s top art and design universities: UdK and Weißensee

- Geographically close to cheap talent: Leipzig, Warsaw, etc.

- There’s some history of large tech companies like Siemens having a strong presence in Berlin, but by the sound of it, at this stage startups are the only game it town in terms of recruiting top technical talent

Increasingly solid community infrastructure

- Lots of co-working spaces: Agora Collective, Ahoy, Betahaus, ClubOffice, Co.Up, LaunchCo, Mobilesuite, Raumstation, St Oberholz, Tante Renate, etc – some spaces are essentially cafes, others are actual office spaces with scheduled activities.

- More on the way: The Factory

- Several accelerator programs: StartupBootcamp Berlin, Mcube, Hubraum, Project A, YouIsNow, Berlin Startup Academy

- Education: General Assembly now offers enterpreneurship courses in collaboration with BetaHaus

- Press: Berlin has its own industry blogs, including Venture Village and Silicon Allee. Techcrunch (largely Mike Butcher) covers extensively Berlin startups.

Still early:

- While it’s been growing for a few years now, the tech ecosystem still generally feels early, compared to London or NYC

- Berlin was always known for hacker culture (chaos computer club) leading to cutting edge outfits in 90’s (art+com, convergence, gate5).

- Started with the Samwer brothers – was a mixed blessing for Berlin. While starting successful businesses, they perfected the art of the startup copycat (with the resulting bad reputation). Examples: StudiVZ (Facebook clone), Citydeal (Groupon clone, assets acquired by Groupon), Zalando (originally a Zappos clone, has expanded beyond shoes since), Wimdu (airbnb clone)

- Now produces original startups (readmill, researchgate, goEuro, etc.), with an increasing number with global relevance and aspirations (SoundCloud)

- Berlin seems still mostly focused on consumer internet companies (with a good amount of mobile plays), with comparatively fewer B2B or enterprise startups; it is not a full ecosystem yet from that perspective, with some exceptions like cloudControl (European PaaS provider)

- While there is a fair distribution of startups across the stages (from seed to late stage), overall the ecosystem is too recent to have a very solid track record of exits. Some examples: ImmoScout (sold to DT for €450m), Idealo (a comparison shopping site, acquired by Axel Springer in 2006), gate5 (today “nokia Maps” employing 800 people in Berlin), StudiVZ (sold to one of its investors, Georg von Holtzbrinck Publishing Group, for €85 million in 2007), MyphotoBook (sold to Holtzbrink), Nugg.ad (provider of predictive behavioral targeting solutions for digital advertising, acquired by Deutsche Post in 2010 for €50M), KaufDa (local search and local promotion search, acquired by Axel Springer), Zanox (acquired by Springer for €250m), Casacanda (online shopping club for daily design inspirations, acquired by Fab.com in February 2012 in an all-stock deal valuing the company at around $10M), Brands4Friends (sold to eBay for €150m, etc.)

- Sounds like the government hasn’t quite caught on – in starck contrast to London or NYC. The success of the Berlin ecosystem seems to have been entirely driven by a grassroot, community effort.

- There’s less VC money available than in other places like NYC (or to some extent London); companies tend to be very capital efficient and tend to monetize early .

- One point people disagreed about: some say the ecosystem is still a bit “clique-ish”, the community hasn’t yet completely geled as a full integrated, selflessly supportive environment (at least compared to SF or NYC) –others disagreed, citing Berlin’s community as one of its key assets.

- Successful entrepreneurs are starting to give back to the ecosystem in the form of active angel investments. Some notable examples: Dario Suter, Fabian Heilemann, Christophe Gras, Christophe Maire, Christian Vollman, Marco Börries, Martin Sinner, Lukasz Gadowski, Michael Brehm, etc.

- Rocket Internet (Samwer brothers) plays have alone raised close to 1bn in 2012 alone and breeds large number of 2nd generation entrepreneurs with international experience. Employs overall 10,000 people in Berlin alone.

- Team Europe, project-A and other Incubators breed ambitious international companies (Madvertise, Delivery hero, Sponsor pay)

Notable Startups

- Soundcloud: world’s leading social sound platform

- Amen: the place for creating and sharing opinions about the extra ordinary things in life.

- Gidsy: community marketplace for authentic experiences

- 6wunderkinder: multi-platform productivity solutions for individuals, groups and businesses

- Wooga: third largest social games developer in the world

- Delivery Hero: global network of online food ordering marketplaces

- Zalando: largest European eCommerce group (including shoes)

- 9flats (peer to peer apartment rentals)

- Lieferheld: platform for ordering and paying food online

- EyeEm: smart photo-sharing application for smartphones

- Txtr: distributed eBooks platform

- Readmill: social and shareable reading platform

- Researchgate: community for researcher and scientists

- MoviePilot: promotion platform for movies (DFJ esprit)

- Monoqi.com: highly curated commerce

- Other companies/products that came back in conversations: HelloFresh, Trademob, Travis-Cl, Fort Rabbit, Cobot.

Angels, seed investors, founder collectives or micro VCs

- Rocket Internet (Dealstreet, Wimdu, GlossyBox, Westwing, 21Diamonds, payleven)

- Team Europe (Delivery Hero, Lieferheld, Madvertise)

- Christophe Maire: Swiss serial entrepreneur, currently CEO of Txtr, investor in soundcloud, Amen, EyeEm, LoopCam, Appaware, PhoneDeck

- Klaus Hommels: Swiss leading European angel investor

- Ashton Kutcher: investor in Amen, Gidsy, Soundcloud

- Martin Sinner: MD at Idealo and active angel

VCs

- US funds: Highland (Wooga, getyourguide), Union Square Ventures (Soundcloud), Kleiner Perkins (Soundcloud), GGV (Soundcloud), RedPoint Ventures (9flats), JP Morgan (Zalando), kinnevik (RocketInternet), Benchmark, FounderFund (Researchgate), Spark Capital (getyourguide)

- International funds: Index Ventures (Soundcloud, Gidsy), Atomico (6Wunderkinder), Balderton (Wooga), DST Global (Zalando), Kite Ventures (Delivery Hero, Lieferheld), ru-Net (Lieferheld), Sunstone Capital (Amen, Gidsy), Wellington Partners (EyeEm, Readmill), e.Ventures (9flats, kaufDa, Dealstreet), Passion Capital (EyeEm), Mangrove Capital Partners, Partech, b-to-v Partners, etc.

- German funds: Earlybird, HV Holtzbrinck, IBB (ClipKit, cloudControl), Earlybird Ventures, BMP Media Investors, Tengelmann Ventures, Dumont Venture, High Tech Gründerfonds (a public private partnership with 10+ corporate investors, currently investing out of a €293.5 million fund), GMPVC (German Media Pool, invested in 9flats).

- Corporates: BDMI, T-Venture (ClipKit, 9flats, 6Wunderkinder).

SumAll, SimpleReach, Hadapt and ClearStory

Our January NYC Data Business Meetup was focused on data analytics.

Here are the slide decks:

Here are the videos:

SumAll

SimpleReach

Hadapt

ClearStory

Panel Discussion

New toy at the office

Joseph Turian, Sqrrl, Infochimps and MemSQL

The December NYC Data Business Meetup was focused on big data infrastructure companies, with the co-founders of Sqrrl, Infochimps and MemSQL presenting to a full house. We started the evening with a presentation by prominent data scientist Joseph Turian.

The slides are here: Joseph Turian, Sqrrl, Infochimps and MemSQL.

Here are the videos:

Intro

Joseph Turian, “How to do AI in 2013”

Oren A. Falkowitz, Co-Founder & CEO, Sqrrl

Dhruv Bansal, Co-Founder & Chief Science Officer, Infochimps

Eric Frenkiel, Co-Founder & CEO, MemSQL

And here are a few pics (photo credit: Shivon Zilis):

Recorded Future, Lex Machina, DataMarket and numberFire

The November NYC Data Business Meetup was focused on “vertical-specific” applications of big data – startups leveraging the big data stack to offer new solutions to specific industries, such as finance and government (Recorded Future), the legal industry (Lex Machina), energy (DataMarket, although it offers data sets for other industries as well) and sports (numberFire).

The slides are here: Recorded Future, Lex Machina, DataMarket and numberFire.

Here are the videos:

Christopher Ahlberg, CEO, Recorded Future:

Josh Becker, CEO, Lex Machina:

Hjálmar Gíslason, CEO, DataMarket:

Nik Bonaddio, CEO, numberFire:

Panel discussion:

Some pics:

IA Ventures, Accel, Data Collective, Precog and CCS at the NYC Data Business Meetup

Here are the videos from the NYC Data Business Meetup that was held on October 23, 2012, in order of appearance:

Jeff Carr, COO, Precog

Max Yankelevich, co-founder, CrowdComputing Systems

Roger Ehrenberg, Founder and Managing Partner, IA Ventures; Ping Li, General Partner, Accel Partners; Matt Ocko, Co-Founder and Partner, Data Collective (from left to right):