[July 14, 2020 IPO update – stock popped + 195% first day of trading, see end of post for details on IPO]

The upcoming nCino IPO is an interesting story, and a good reminder that strong cloud/SaaS companies can be built outside of the usual Silicon Valley or NYC venture path (even with VCs on board)

(As a side note: we often do those S-1 summaries internally to keep tabs on the software IPO market, so my colleague Avery Klemmer and I figured we’d “open source” this one in case it might be interesting to others – thoughts and comments welcome. Our firm FirstMark is not an investor in nCino)

HIGH LEVEL THOUGHTS & LESSONS:

nCino is a refreshing example of a successful software company that’s built a little bit outside of what’s currently in favor in venture capital circles:

- Vertical software: Many VCs these days tend to prefer broad horizontal opportunities, with a concern that vertical software ultimately has a limited TAM, even a large one – but nCino is 100% focused on the banking market

- Service heavy, no bottoms up GTM: nCino sells its products through AEs , with long sales cycles, and significant implementation services are involved

- Platform dependency? Being built on top of someone else’s platform is often a concern for investors. nCino is built on top of Salesforce (like Veeva). They’ve seemingly safeproofed this relationship by reselling Salesforce products in their deals, and raising money from Salesforce, wnich is a large investor.

- Not a Silicon Valley or NYC story: Launched in 2012 by executives of North Carolina-based Live Oak Bank as a spin-off venture. Still based in Wilmington, North Carolina

- It’s a spinoff from a bank: the company was originally founded as a majority-owned subsidiary of Live Oak Bancshares, a bank holding company. It then raised $9m in seed funding in 2013 from a variety of individuals including John Mack of Morgan Stanley and Chip Mahan, the Chairman of Live Oak Bank. So nCino didn’t have the structure that most VCs like to see, where the founding team has high ownership and the first money in comes from institutional investors. This history as a spin-off is probably the reason why the CEO of the company owned only 1.6% at IPO time, although we don’t know this for sure).

NOTES

- Product: multi-tenant SaaS to digitize bank workflows including bank onboarding, loan origination, and account opening

- Built on salesforce, currently on a 7 year license with them

- Background: started in a bank, spun out in 2011

- Market: $10B serviceable addressable market

- Financial Results:

- Revenue (FY18, 19, 20): $58M, $91M, $138M (54% CAGR, subscription growing at 65% CAGR)

- $178.8M Q1 2021 run rate – on the lower end of the spectrum of recent SaaS IPOs

- $35M of services revenue in FY20

- Blended Gross Margin (FY18, 19, 20): 48%, 49%, 54%

- Subscription Gross Margin (FY18, 19, 20): 67%, 69%, 70%

- Net loss (FY18, 19, 20): $18.6M, $22.3M, $27.6M

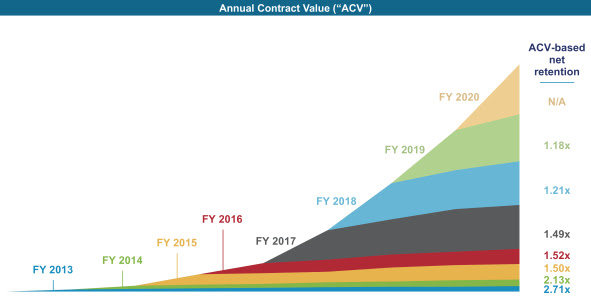

- Subscription Revenue Retention (FY18, 19, 20): 188%, 163%, 147% – strong “land and expand”

- Customers:

- 1.1K financial institutions on the platform

- 290 total customers

- Customers include BofA, Barclays, Santander, TF, as well as community banks and credit unions

- 161 > $100K ACV customers

- 21 > $1M ACV customers

- Shareholders (pre-IPO stakes):

- Insight — 46.6%

- Salesforce — 13.2%

- Wellington% — 9.5%

- CEO — 1.6%

- Total raised: $213.2M from Salesforce, Insight, Wellington, T Rowe Price

July 14, 2020 Update:

- IPO turned out to be pretty spectacular

- Roadshow was done fully virtually, reaching over 800 individuals and over 300 institutions, with 31 1×1 meetings and 11 group meetings

- According to BoFA, nCino generated $11.8 billion total aggregate dollars of demand – an order book that was ~50x oversubscribed based on indications of interest and over 17x covered on a 1×1 basis

- The final price was $31 per share, above the initial $22-$24 range and the revised $28-$29 range (representing a 35% file / offer premium)

- According to BoFA, nCino priced its IPO at the highest forward revenue multiple ever for a vertical SaaS company (i.e. in the double-digits)

- The NCNO stock popped +195.45% on the first day of trading (compared to original price), closing at $91.59

- While exciting from a demand perspective, this is yet another example of the IPO market not functioning efficiently, at least from the perspective of the company, which could have raised a lot more money if the shares had been properly priced by the underwriter to reflect accurate market demand for the shares. As a reminder about how those things work:

- IPO investors purchase the shares from the company at the offering price.

- Therefore, the company sold shares last night at the offering price of $31 a share ($250m worth of shares in total)

- Yet this morning trading opened up at $71 this morning and closed at $91.59)

- Therefore the IPO investors (who are free to sell their shares in the open market once trading begins) had an immediate and very substantial gain today, but the company did not.