Today, we are previewing a new public market index – the MAD (for machine learning, AI and data) index.

Readers of this blog know that we have been tracking the data ecosystem since 2012, through annual landscapes (see the 2020 Data & AI Landscape).

Over the last few years, a funny thing happened – some of the small startups we had started tracking grew up, did an IPO and became large public companies.

Not so long ago, public market investors used to say there’s was no good way of “playing” the Big Data and AI trends, due to the lack of public companies in the space. This is less true today.

However, there isn’t much out there in terms of looking at those public companies as a group. For example, see this Seeking Alpha piece, Top 3 Artificial Intelligence ETFs To Consider, where none of the companies listed are actually AI companies.

Hence the idea of the MAD Index. It’s still a small group of companies, but my colleague John Wu and I were curious to see how they fared in public markets, now and going forward.

This is just a start. We anticipate that a number of companies will join this group in the next year or two, and we’re excited to see how this index matures.

Methodology

Now, the hard part. How did we go about selecting companies to include in the MAD index?

Our philosophy here is to cover companies that are as close as possible to “pure” data or ML/AI, which of course is a fuzzy concept. Our North star is that data or ML/AI should be the the essence of what those companies do, as opposed to an ingredient in an overall mix – otherwise, we’d end up with a very long list of companies (our fundamental thesis on the space is that every company will eventually be a data and ML/AI company).

In practice, that means: infrastructure companies directly focused on the processing of data and the creation or enablement of ML/AI, as well as a few broadly horizontal companies at the application layer.

More specifically, we used the following criteria:

- Publicly listed company on US-based exchanges (we’re big believers that great data and ML/AI companies are being built all around the world, but this is meant as a US public market index)

- Software or infrastructure as a service only

- Data/artificial intelligence/machine learning product accounted for majority (>50%) of company’s revenues (based on the information we have)

- Product offering can be applied generically across a range of cross-industry use cases

Conversely, the following types of companies were excluded:

- Big cloud vendors where the data and ML/AI offering cannot be separated from the rest of the infrastructure offering (and even less so from the big mothership — e.g., GCP for Google and AWS for Amazon)

- Companies with AI/data offerings in a vertical or non-general manner in one segment (e.g., Verisk Analytics focused on risk and Waymo building autonomous vehicles)

- Companies that heavily use AI, but for a specific set of internal/product use cases (e.g., Netflix, Spotify, Facebook, Intel)

- Hardware vendors, including chip makers like NVIDIA

- Data brokers like IHS Markit and Experian

The List

Here’s our initial list of 13 companies in the MAD Index, as well as some key metrics:

Nearly all the companies in this list went public within the last 5 years. Both the median and average listing years were 2017.

The most recent public additions are C3 (debuted in December 2020), Snowflake, and Palantir (both September 2020).

However, particularly given the relatively small number of public data and ML/AI companies, we decided to include some relatively older players like Teradata (which went public in 2007) and Splunk (2012).

The group of relevant companies will evolve over time – for example, both Couchbase and UiPath have filed to go public. As more companies join the MAD Index, we may consider focusing this index on more recently IPO’ed companies only.

In the meantime, there’s a reasonably wide spread within the MAD index, across three groups of companies:

- High Growth (green, in the charts below) – Companies growing at greater than 35% YoY with proportionally higher LTM Enterprise Value/Revenue multiples of under 15x (C3, Datadog, Palantir, MongoDB, Elastic, Snowflake)

- Moderate Growth (yellow) – Midcap companies growing at ~10 to 25%, with revenues of sub $1B (Alteryx, Talend, Cloudera, Domo, Veritone)

- Contracting (blue) – Companies experiencing slow YoY growth or slight contraction, with more than $1.5B in annual revenue (Teradata, Splunk)

Growth vs. LTM Revenue

As one would expect, this is a high revenue growth group on the whole, with Snowflake leading the pack at a blistering pace of 124% YoY.

However, Splunk and Teradata are experiencing slight year over year revenue contraction. Launched before the cloud wave took place, Splunk is making the transition from on premise installations and perpetual/term licenses to a cloud-based subscription model. Teradata, which has continually reinvented itself since being founded in 1979, has seen a slow revenue decline over the past few years, as cloud data warehouse providers have gained market share.

EV/Revenue vs. Growth

Growth and LTM revenue multiple are directly correlated for companies in the index.

High growth companies (25%+ YoY revenue growth) significantly outperform their modestly growing peers.

Trailing 12 month (LTM) revenue multiples have largely rewarded the fastest growing companies within this subset – all companies growing over 25% YoY are trading at over 25X LTM revenue with the exception of Elastic, which is trading at 17.4X with 44% YoY growth.

Snowflake is the outlier for both growth and trailing multiple, growing at over 100% a year while valued at 52X.

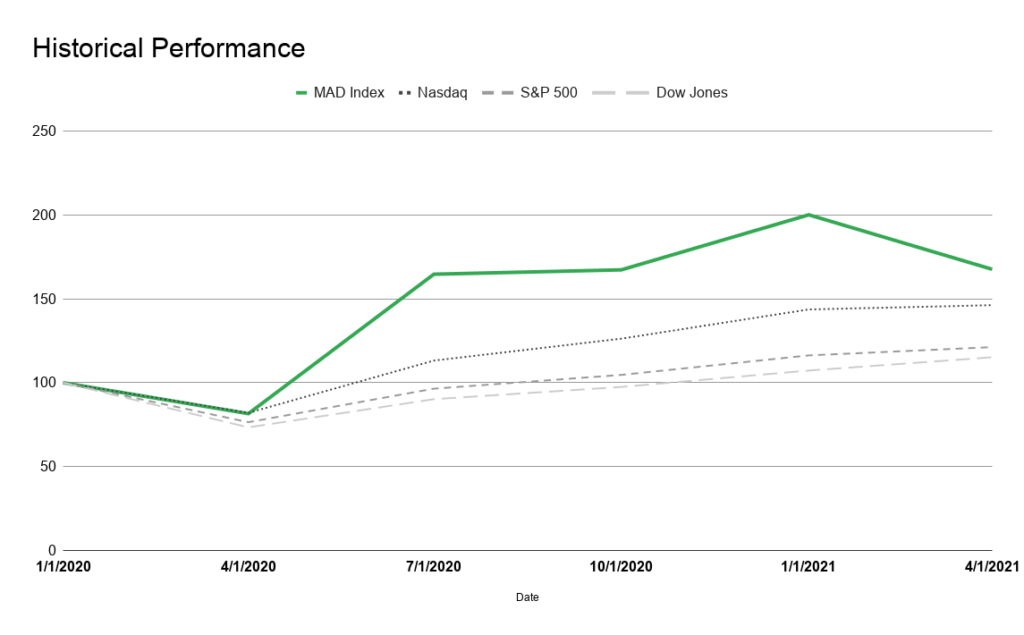

Historical Performance

Even weighted down by a couple of older companies, the MAD index outperformed the major indexes over the last five quarters, beating Nasdaq gains by 47%, the S&P gains by 219%, and the Dow Jones gains by 347%.

However, in the recent market drawback, these companies also experienced the most losses from their historical highs.

It is likely that data companies will continue to outperform the market, given the lack of maturity in data infrastructure outside of the most technologically forward companies.

Index Value (3/2021)4

With January 1, 2020 value as 100

| Index | 1/1/2020 | 4/1/2020 | 7/1/2020 | 10/1/2020 | 1/1/2021 | 4/1/2021 |

| MAD Index | 100.00 | 81.56 | 164.63 | 167.24 | 200.03 | 167.56 |

| Nasdaq | 100.00 | 82.03 | 113.17 | 126.23 | 143.64 | 146.18 |

| S&P 500 | 100.00 | 76.47 | 96.44 | 104.64 | 116.26 | 121.19 |

| Dow Jones | 100.00 | 73.39 | 90.18 | 97.47 | 107.25 | 115.15 |

What’s Next?

It’s still early days for public data and ML/AI companies as a group. We are just at the beginning of this trend playing out in the long run.

We expect many more companies to join the group. Most of these companies are still early in both product and commercialization. We are planning on tracking them through another list, our Emerging MAD Index, coming up soon!

This MAD Index is a work in progress, and comments are certainly welcome.

Disclaimer: All of the above is something we wrote because we are passionate about the space — this not investment advice!

Footnotes

1 https://venturebeat.com/2013/11/11/data-scientists-needed/

2 https://www.sciencedaily.com/releases/2013/05/130522085217.htm

4 Index Reweighting: A divisor is created at the start of the index equal to the amount needed to set the index equal to 100 when dividing the total market cap of the companies in the index by the divisor. Each time a company is added to the index, the divisor is updated by dividing the total market cap of the companies (including the new company) by what the index’s value would have been without the new company added in that time period. The total market cap of the companies including the new company would then be divided by the new divisor to set the index value during this and subsequent periods.

Great list! The correlation trends make sense and provide hints to how this landscape will emerge in future. Given Talend is acquired by PE firm Thoma Bravo, will you continue to track it in this index?

Thank you. We’ll remove Talend when the transaction closes and it gets delisted, but for now the total universe of companies that qualify for the list is so small enough that we included all the companies we could.

What is the prognosis for startups higher in the stack who are building upon the MAD companies in a horizontal manner? They may become large, “broadly horizontal companies at the application layer”.

Yes, we’re very bullish on the application layer of MAD as well, in which we actively invest (in private markets). For purposes of this index, though, we’re trying to keep it tight to MAD pure-plays. We’ll probably include some broadly horizontal applications as they become public, like UiPath (although you could debate whether UiPath is truly an AI company as of right now).

Did you consider including Microstrategy? They are a data product although the stock is mostly correlating to their Crypto holding.

That’s an interesting thought, thanks… Short answer, no, we didn’t. On the whole, probably want to keep this as an index of mostly newer/modern data companies, although Teradata arguably doesn’t entirely fit. Will give it some thought.