1) Be an AI leader: Buy at least one share of Open AI in that employee secondary at an $86B valuation – then change website and all social profiles to “early believer and investor in Open AI”

2) Leverage the network: In conversation, drop frequent references to “Sam”, “Satya” and “the Besties” – I put in the hours building the relationship, by liking their tweets and listening religiously to the All-in podcast, now people need to know I’m tight with those guys

3) Add value: Formula 1 is a major sport in the US now, and founders in my portfolio will want know that I “get it”. Plan on attending several Grand Prix in 2024. While in Miami, Vegas or Monaco, send founders energizing texts like “Do you have the DRIVE TO SURVIVE?”, or “What would it take for us to be in POLE POSITION next year?”. They may not reply, but I know they will appreciate.

4) Refine investment thesis: Ok, so, I haven’t really done a new deal in over a year. What do other VCs invest in these days? AI is cool but exhausting, changes like every day. Defense tech seems hot, and blowing sh*t up is fun, so maybe? Heard about “nuclear fusion” and “superconductor” – ask ChatGPT to explain those “like I’m 5”, then tweet that out, to establish thought leadership

5) Inspire: Founders love it when VCs tweet during weekends and holidays things like “How bad do you want it?” or “Hustlers never rest!”. Pre-schedule a bunch of those tweets to automatically publish throughout the year.

6) Be a VC leader: Founders calling me all the time gets annoying, but I always have time for journalists. On the record, comment on VC firms doing layoffs or shutting down and say it’s “healthy for the industry”, but doesn’t affect me because I’m “top quartile”. Off the record, give the journalist a list of GPs who beat me on deals as examples of folks who are “in serious trouble”.

7) Stay fit: First it was kitesurfing, then it was pickleball. These days it’s jiu-jitsu a la Zuck, Elon and Lex Fridman. Possibly also padel? Gosh, few understand the level of pressure VCs are under to perform.

8) Be a master planner: Didn’t do a good job planning last year. Designer clothes showed up late at Art Basel, didn’t get my usual suite upgrade at the Crosby Hotel in SoHo, and missed the best DJ set at Slush. Do better in 2024. Upgrade my boat setup for Mykonos this Summer, and be the ultimate “man in the marina”.

Happy new year! LFG 2024!

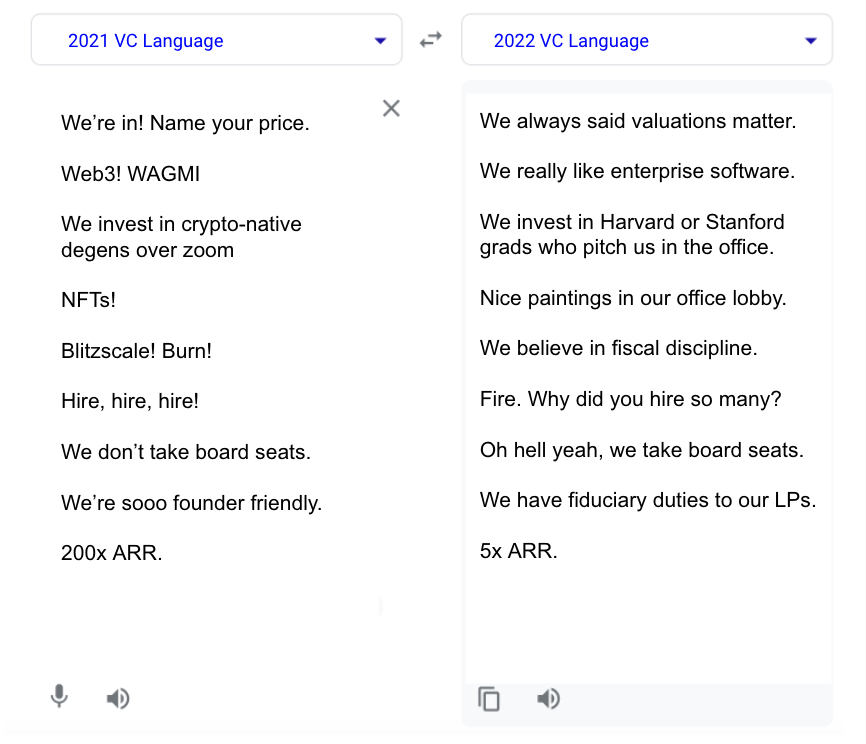

P.S. Holding myself to the highest standard year after year, see 2023 VC resolutions, 2022 VC resolutions