Is the Internet of Things the world’s most confusing tech trend? On the one hand, we’re told it’s going to be epic, and soon – all predictions are either in tens of billions (of connected devices) and trillions (of dollars of economic value to be created). On the other hand, the dominant feeling expressed by end users (including at this year’s CES show, arguably the bellwether of the industry) is essentially “meh” – right now the IoT feels like an avalanche of new connected products, many of which seem to solve trivial, “first world” problems: expensive gadgets that resolutely fall in the “nice to have” category, rather than “must have”. And, for all the talk about a mega tech trend, things seem to be moving at the speed of molasses, with little discernible progress year on year.

Part of the problem is perhaps one of semantics. While gadgets are indeed part of the category (and quite often very large markets onto themselves), the Internet of Things (which we define as any “connected hardware” other than desktops, laptops and smartphones) is a much broader, and deeper, trend that cuts across both the consumer, enterprise and industrial spaces. Fundamentally, the Internet of Things is about the transformation of any physical object into a digital data product. Once you attach a sensor to it, a physical object (whether a tiny one like a pill that goes through your body, or a very large one like a plane or building) starts functioning a lot like any other digital product – it emits data about its usage, location and state; it can be tracked, controlled, personalized and upgraded remotely; and, when coupled with all the progress in Big Data and artificial intelligence, it can become intelligent, predictive, collaborative and in some cases autonomous. An entirely new way of interacting with our world is emerging. The importance of the IoT perhaps emerges more clearly when you think about it as the final chapter of “software eats the world”, where everything gets connected.

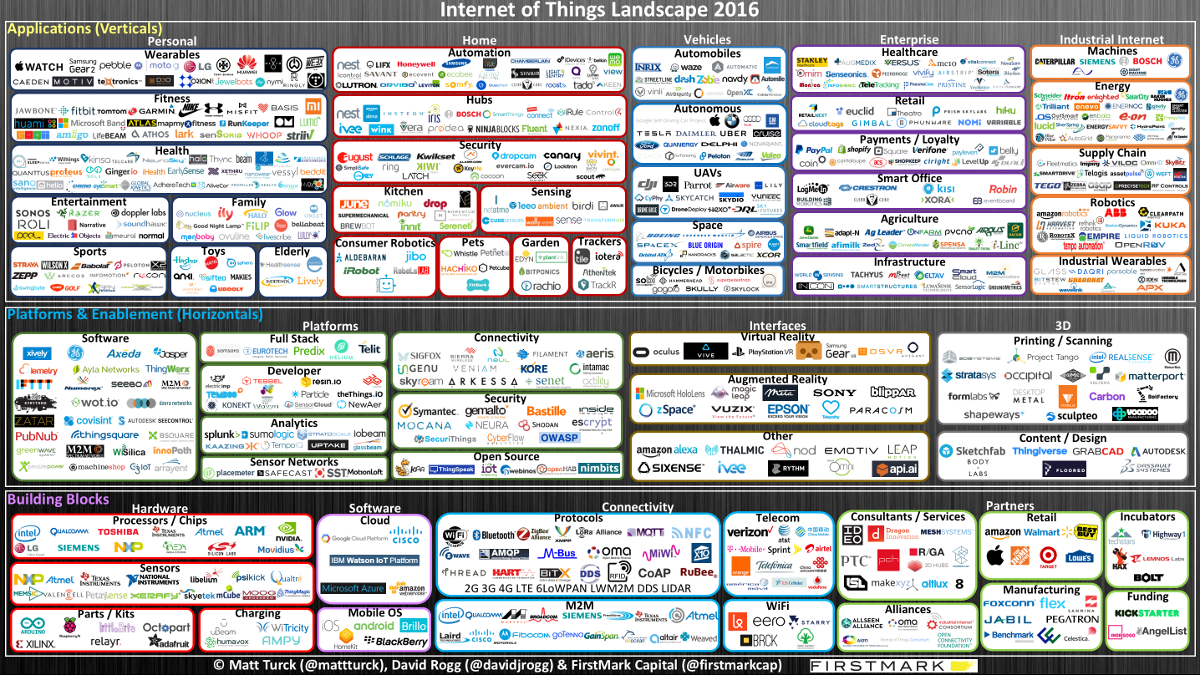

Just as for the Big Data world, the annual update to our Internet of Things Landscape (scroll below for the 2016 version) is a great opportunity to check in on the industry. In 2013, we were trying to make sense of the Internet of Things; in late 2014, it seemed that the IoT had reached escape velocity. In 2016, the IoT space continues to hold considerable promise, but equally, and unsurprisingly, there’s no shortage of obstacles – there is a long road ahead and this trend will unfold over many years, possibly decades.

What’s taking so long?

Remember the Internet in 1999? Or, if you’re younger, mobile phones in 2007? This is essentially where the Internet of Things is today. In 1999, the Internet had already many signs of greatness (Google and Amazon were getting in full swing) but was often a frustrating experience (oh, the joys of “dialing up”), or possibly a scary one (putting my banking details into this website, really?). In 2007, mobile phones had already achieved many of the key progress (smaller form factor, Internet connectivity through WAP sites) and the first iPhone was just being released but it was hard to fully imagine the breadth of the smartphone revolution that was about to take place.

The IoT today is largely at this inflection point where “the future is already here but it is not evenly distributed”. From ingestibles, wearables, AR/VR headsets to connected homes and factories, drones, autonomous cars and smart cities, a whole new world (and computing paradigm) is emerging in front of us. But as of right now, it just feels a little patchy, and it doesn’t always look good, or work great – yet.

There are two broad categories of reasons that slow down progress.

One is simply the general immaturity of the ecosystem – par for the course for any emerging space, where a lot of aspects need to be figured out at the same time. A fundamental aspect of the vision of the IoT is not just for devices to be connected to the Internet, but also for devices to be connected seamlessly to one another – but as of now, interoperability largely does not exist, a blatant and abundantly documented issue: too many standards and not enough people agreeing among them. There is a whole list of other difficult technical problems. Start with connectivity for example – it remains often surprisingly difficult to connect things to the Internet, particularly in industrial contexts (hot, humid environments with no cell or WiFi connectivity and/or far away from urban centers). A lot of Big Data related questions need to be figured out, including how to process data locally, at the sensor or network level (what’s known as “fog computing”, still an early space) to minimize the need to have to send gigantic amounts of data to the cloud – it is unclear whether the current data infrastructure would be able to withstand the tidal wave of data created by the IoT otherwise. Security and privacy issues are fundamentally important and companies are just starting to get a sense of the various ways trouble can appear – those concerns will increasingly move to the top of everyone’s agenda in the near future. Regulations and laws also need to adapt: with the emergence of drones/UAVs and autonomous vehicles, regulators are confronted with an entirely new set of problems and are understandably cautious. All of those are solvable problems, but finding solutions will require time.

The other category of issues has to do with the fact that, unlike the Internet, the IoT has to deal not just with bits, but with atoms. The Internet was an unbelievably unique opportunity to invent a whole new universe online with remarkably little friction, as (almost) everything is software. In sharp contrast, the IoT has its feet firmly planted in our daily reality, and needs to deal with the laws of physics, distance and time.

Before they can become those magically smart and collaborative products, connected devices are first and foremost hardware products. And, as many new IoT entrepreneurs and VCs have had to (re-)learn over the last 2 or 3 years, building a great hardware product takes a very long time. It’s also a very unforgiving process. As one can’t iterate as fast with hardware as with software, there’s no such thing as a Minimum Viable Product, or a “f*ck it, ship it” mentality in hardware. Once the product goes into manufacturing, there’s no turning back, and any mistake in design requires a redo that can cost months of delays. At least based on the conversations I have with entrepreneurs and VCs, it seems that it takes the average IoT startup a solid 18 to 24 months to actually ship their first product (my impression, not based on actual data). However hard it might be, shipping is only part of the battle, as distribution comes next – while online sales are great, to truly move units, a startup needs to work with retailers, who have their own priorities and time constraints. It may take another year or two until a startup has truly “nailed” distribution across multiple channels and start selling in large quantities. All of this also affects price: it is hard for IoT startups to offer cheap products because of the cost of the various hardware components and because retailers put additional pressure on margins – this in turns slows down consumer appetite (high price is the #1 deterrent to adoption of consumer IoT products according to this 2016 Accenture survey). Every startup wants to get as fast as possible to the critical mass stage where the product delivers an amazing experience through software, data and community and where the business starts benefitting from economies of scale and data network effects, but the tough reality is that many (most) startups today are in the trench warfare phase where they need to successfully deal with manufacturing and distribution.

In addition, outside of new spaces such as AR, VR and drones, most new connected products are meant to replace existing “analog” objects. As a result, large-scale adoption of the IoT is going to be somewhat subjected to natural cycles of replacement of those existing products. Certainly, tech enthusiasts and other early adopters will not wait, but on the whole consumers and enterprises are unlikely to rip and replace their existing equipment overnight, particularly when it comes to more expensive items. Consumers may replace their phones every year or two, but locks, kitchen appliances and cars often last a decade or more. In the industrial world, machines can last 15 or 20 years. Of course, many startups have created solutions to retrofit their products on existing hardware, so there is a path to quicker adoption. But the gigantic upgrade required to truly transition to an IoT world may not be fully completed until connectivity is built natively into the next generations of homes (e.g. new condos coming with full home automation pre-installed), vehicles or factories.

Some parts of the ecosystem may buck the trend and move comparatively faster. For example, there are reasons to believe that autonomous vehicles could arrive sooner than expected – some observers predict the emergence private/public partnerships allowing for the full-scale, real-life use of fully autonomous vehicles in pilot cities in the US in the next 12-18 moths. If something like this happened, this whole segment could accelerate quickly, particularly if manufacturers are able to prove that autonomous cars are in fact miuch safer than human drivers. But even so, our world’s infrastructure would need to evolve to allow for mass-scale adoption of autonomous cars, which would still take years (for interesting takes on this question, see here and here).

Sustaining the startup “Big Bang”

Progress may seem slow to end users, but the IoT startup ecosystem is booming. This is a broad market – in some ways a collection of distinct markets that have a lot in common, but also follow different dynamics to some extent. However, we see new companies appearing and young startups scaling across the board.

As of the beginning of 2016, we are perhaps 3 or 4 years into an explosion of startup activity in the IoT (technically, the second one after an earlier false start), particularly on the consumer IoT side. Incubators (both hardware specific and now generalists like Y Combinator and Techstars) crank out legions of startups. Crowdfunding (despite not being the silver bullet it once appeared to be) provides early financing. The large Chinese contract manufacturers demonstrate openness to working with startups and sometimes invest in them. Service providers such as Dragon Innovation do a lot of hand holding.

While the Silicon Valley engine keeps producing exciting companies, IoT entrepreneurship is a broader, more global phenomenon. Mattermark’s list of the top 100 IoT companies (here) has a majority (52 companies) located outside the Bay Area. In our 2016 IoT Landscape, over 150 companies are located outside the US. Anecdotally, there was a whopping 160 French startups represented at this year’s CES. And of course, China has become the workshop of the entire hardware world. Separately, it is also worth noting that hardware entrepreneurship is also comparatively diverse with many female CEOs in particular (see here).

Venture capital dollars in the space have continued to increase: $1.8 billion in 2013, $2.59 billion in 2014 and $3.44 billion in 2015, according to CB Insights (whose list of IoT companies is less broad than our landscape). The number of deals has decreased slightly (307 in 2013, 380 in 2014 and 322 in 2015), presumably reflecting a natural evolution towards proportionally less seed deals and more dollars going towards a smaller number of later stage companies. As recently as 18 months ago, when the space was still very much in its infancy, there was a relative dearth of companies at the Series B (or later) level. But since the last version of our landscape, this has changed very noticeably, with a whole group of companies raising mid to late stage rounds, including for example: Sigfox ($115M Series D in February 2015), 3D Robotics ($50M Series C in Feb 2015), Peloton ($30M Series C in April 2015), Canary ($30M Series B in June 2015), littleBits ($47M Series B in July 2015), Netatmo ($33M Series B in November 2015), Athos ($35M Series C in November 2015), Greenwave ($45M Series C in January 2016), Jawbone ($165M Series E+ in January 2015), FreedomPop ($50M Series D in January 2016), Razer ($75M Series C in February 2016) and Ring ($61M Series C in March 2016).

However, on the whole, hardware is a little bit of an acquired taste for most VCs (for my thoughts on how VCs view the space, see here). The Fitbit IPO in 2015 was an important moment in demonstrating that an IoT startup could be wildly successful and offer sound financial metrics (FitBit is very profitable whereas most SaaS companies are not), but many traditional VCs still view hardware startups with a suspicious eye, and IoT investments often remain largely experimental. Hardware startups are much less capital intensive than in the past, but from what we see in the market, it still takes a solid $10M in combined financing for a hardware startup to truly get going (ship and get early sales traction beyond pre-orders), at least in the US (a number of European companies have had to do it with less, as VC financing at those levels was less of an option).

Fortunately for the space, strategic/corporate investors have been stepping in in a major way. In fact, again according to CB Insights (here), the top two most active investors in the space are corporate: Intel Capital and Qualcomm Ventures, with Cisco also appearing in the top 10 alongside traditional VC funds. Verizon Ventures, GE Ventures, Comcast Ventures, Samsung Ventures are also active. This is true internationally as well Netatmo’s Series B round was led by industrial company Legrand and Sigfox Series D round was led by Telefonica and other leading telecom companies. Asian investors have been active as well, with FoxConn occasionally leading rounds and Singapore’s EDBI being a significant late stage investor, for example.

If the VC financing market continues to cool down in the US, the impact on the IoT ecosystem could be significant. In tough markets, emerging areas tend to be disproportionally affected, and historically corporate and foreign investors have tended to be less active in turbulent times – but perhaps the startup financing landscape has evolved to a point where this will be not the case this time.

For now, with startup creation and funding in full swing, we can barely keep track of all new IoT startups appearing on the market. Certain areas, particularly on the consumer IoT side (most blatantly, wearables, fitness and home automation) are now overcrowded, inevitably raising the specter of failure and forced consolidation. The enterprise and industrial sides of the Internet of Things are more open, bearing in mind that some existing players in those spaces have been operating for decades.

Here’s our 2016 landscape:

To see the landscape at full size, click here. To view a full list of companies, click here.

As in previous versions, the chart is organized into building blocks, horizontals and verticals. Pretty much every segment is seeing a lot of activity, but it is worth noting that those parts are not particularly well integrated just yet, meaning in particular that vertical applications are not necessarily built on top of horizontals. To the contrary, we’re very much very much in the era of the “full stack” IoT startup – because there is no dominant horizontal platform, and not enough mature, cheap and fully reliable components just yet, startups tend to build a lot themselves: hardware, software, data/analytics, etc. Some enterprise IoT companies, such as our portfolio company Helium, also have a professional services organization on top, as enterprise customers are at the stage where they try to make sense of the IoT opportunity and are looking for something that “just works”, as opposed to mixing and matching best of breed components. This is a typical characteristic of startups operating in an early market, and I would expect many of those companies to evolve over time, and possibly ditch the hardware component of their business entirely.

Dancing with the giants

To fully make sense the IoT ecosystem, it’s important to fully realize that large corporations are omnipresent in it. I mentioned this in an earlier post about home automation, but a glance through the 2016 IoT landscape will quickly establish that they are active in pretty much every single category.

In the Internet era (90s and 00s), the dynamic was brutal but pretty simple (at least in retrospect) – on one side, there were the disruptors (Internet-native startups with no legacy); on the other side there were the disrupted (bricks and mortars and other large incumbents paralyzed by the innovator’s dilemma). In the IoT era, things are a little trickier – some of the startups of the Internet era have grown up to be large companies themselves, for example, and it is less clear who is best equipped to disrupt who.

Large public tech and telecom companies have been all over the IoT, which they rightly regard as something that will truly move the needle for them over the next few years and possibly decades. It is entirely possible that, in some cases, announcements are ahead of reality, but nonetheless the trend is clear. Chipmakers (Intel, Qualcomm, ARM) are racing to dominate the IoT chip market. Cisco has been incredibly vocal about the “Internet of Everything” and walked the talk with the $1.4bn Jasper acquisition a few weeks ago. IBM announced a $3 billion investment in a new IoT business unit. AT&T has been aggressive in being the connectivity layer for cars, partnering with 8 out 10 top US car manufacturers. Many telecom companies view their upcoming 5G networks as the backbone of the IoT. Apple, Microsoft and Samsung have been very active across the ecosystem, offering both hubs/platforms (Homekit for Apple, SmartThings and an upcoming OS for Samsung, and Azure IoT for Microsoft) and end products (Apple Watch for Apple, Gear VR and plenty of connected appliances for Samsung and the upcoming HoloLens AR headset for Microsoft). Salesforce announced an IoT cloud a few months ago. The list goes on and on.

Alphabet/Google and Amazon are probably worth mentioning separately because of the magnitude of their potential impact. From Nest (home) to SideWalk Labs (smart cities) to autonomous cars to the Google Cloud, Alphabet already covers huge portions of the ecosystem, and has invested billions in it. On Amazon’s end, AWS seems to be an ever increasing force that keeps innovating and launching new products, including a new IoT platform this year which it inevitably push aggressively to become the backend for the IoT; in addition, the company’s eCommerce operations are increasingly important to IoT products distribution, and Echo/Alexa is turning out to be a major sleeper hit for the company in the home automation world. Both Alphabet and Amazon very much move at the speed of the startups they were not so long ago, sit on immense amounts of user data, and have limitless access to top talent.

Outside the technology world, many “traditional” corporate giants (industrial, manufacturing, insurance, energy, etc.) have both a lot to gain and lot to fear from the Internet of Things. This is a perhaps unprecedented opportunity to rethink just about everything. The IoT will essentially enable (or perhaps, force) large companies to evolve from a product-centric model to a service-centric model. In an IoT-enabled world, large companies will have direct knowledge about how their customers actually use their products; they will be able to market and customize their offerings to a variety of needs (through the software); they will be able to predict when the product will fail and may need support; and they’ll have an opportunity to charge customers by usage (as opposed to a one-time purchase cost), opening the door to subscription models and direct long-term relationships with customers. The impact of those changes on supply chain and retail is likely to be enormous. On the other hand, the threat is immense – what happens to the car industry, for example, as autonomous vehicles become a reality powered by software developed by Google, Apple, Baidu or Uber? Will they be relegated to the status of part maker?

The opportunity to thrive in an IoT world hinges largely on those companies’ ability to gradually evolve into software companies, an immensely difficult cultural and organizational transformation. Some traditional industry companies already have software arms – see Bosch Software Innovations for example or this piece about how General Electric recruited hundreds of software developers in its new Silicon Valley tech offices – so this is not an impossible task, but many companies will struggle immensely to do so.

What does this all mean for startups? Of course, the interest from large companies opens the door to all sorts of acquisition opportunities, both small and large, and sometimes for amounts that are largely disconnected from existing traction (see Nest, Oculus or Cruise) – large tech companies have already demonstrated their acquisition appetite, and large traditional companies will most likely need to acquire their way into becoming software companies. On the other hand, for new startups intending to stay the course and become large independent companies, the path will occasionally be fairly narrow and will require astute maneuvering. Larger companies (e.g. Alphabet/Nest) will certainly not build every single connected product (e.g., every home automation device), but at the same time they will likely preempt the larger opportunities in the space (e.g. being the home automation platform). Or occasionally they will be incredibly aggressive in pursuing the best talent in the market – let’s remember how a few months ago, Uber poached 40 robotics researchers from Carnegie Mellon to help fuel its self-driving technology ambitions. For young startups, the successful strategy will probably involve a combination of finding the right tip of the spear away from the more crowded areas of the market, and partnering with the right large corporate giants to have access to their manufacturing and distribution networks.

Conclusion

The Internet of Things is coming. Obstacles abound, but as our landscape shows, there is an immense amount of activity happening worldwide from both startups and large companies that make this conclusion all but inevitable. Progress may seem slow in some ways, but in fact it is happening remarkably quickly when one pauses to think about the magnitude of the change a fully connected world requires. What seemed like complete science fiction 10 years ago is in the process of becoming reality, and we are getting very close to being surrounded by connected objects, drones and autonomous cars. The bigger question might be whether we are ready as a society for this level of change.

Every month, we host many of the best CEOs, CTOs and founders in this space at our Hardwired NYC event. If you’re in town, please come join us! In the meantime, you can see all videos of previous events on our YouTube Channel here.

____________________

NOTES:

1) First and foremost, a big thank you to our FirstMark associate David Rogg who did a lot of the heavy lifting on this landscape and was immensely helpful. Special thanks to Dan Kozikowski and Krystal Shih as well.

2) As it became very clear very quickly that we couldn’t possibly fit all companies we wanted on the chart, we ended up giving priority to startups that have raised one or several rounds of venture capital financing – certainly an imperfect criteria (but, hey, we’re VCs…), and we’ve occasionally made the editorial decision to include earlier stage startups when we thought they were particularly interesting.

3) As always, it is inevitable that we inadvertently missed some great companies in the process of putting this chart together. Did we miss yours? Feel free to add thoughts and suggestions in the comments

4) The chart is in png format, which should preserve overall quality when zooming, etc.

5) Disclaimer: I’m an investor through FirstMark in Helium, Kinsa and Sketchfab. Other FirstMark portfolio companies mentioned on this chart include Body Labs, Starry and ROLI.

Matt, great post. One thing I think worth mentioning is that IoT isn’t a single market, it’s a broad technology transition (digitization) of at least twenty large sub-markets like manufacturing, telematics, energy utilities, etc.. Each of those have their own depreciation cycles, risk/adoption curves, and organizational/business model challenges in redesigning how they monetize their relationships with their own customers. This will take many years to sort out, as brownfield opportunities will overshadow greenfield deployments for some time, as your portfolio company Helium can attest with high-value refrigerators in hospitals and such.

Thanks and yes, I agree. Perhaps I’ll end up splitting this landscape into Consumer IoT and Enterprise/Industrial IoT in future years.

Thank you Matt for this amazing post and fantastic research. Internationally I see the gap between the US and the rest of the world increasing mostly for lack of finding the right talents as well as the number of right talents. Your view?

Do you mean that it’s harder to find talent internationally?

Yes Is it harder to find talent internationally?

Hard to generalize either way, and it depends on what kind of talent. There’s been less hugely successful Internet ventures internationally so far, so there are comparatively less businesss people at all levels (management, design, product management, online marketing) who have directly experienced hypergrowth and have learned how to scale an Internet company — which by all means does not mean that there are none (btw, that’s true of New York as well or any location outside the Silicon Valley). On the other hand, there’s PLENTY of technical talent internationally (both software and hardware), which often costs much less and is much more loyal than technical talent in the Silicon Valley.

Matt, a very thoughtful post on the state of IoT space. I can’t agree more that “Progress may seem slow in some ways, but in fact it is happening remarkably quickly when one pauses to think about the magnitude of the change a fully connected world requires.” The IoT startups are crossing a deeper and wider chasm today partially due to the compressed early adoption phase caused by the efficiency of social media and crowdfunding sources. However, so many mass market verticals will be profoundly reshaped once these chasms are crossed.

Great point on the compression of the early adoption phase, Albert. Also, I think we all got a bit spoiled over the last few years as we enjoyed the application phase of both the web and smartphones, and got perhaps a little too used to exciting new apps and services popping up on the radar all the time, so we expect things to move very fast. Btw, you guys at Qualcomm Ventures are doing great work helping build this entire ecosystem.

That is a very important question but the answer is ironically less important. You see the IoT will not be rolled out in the conventional sense, it will simply emerge driven by usecases that clearly improve our quality and quantity of life [B2C] or drive cost out of the firms that do [B2B]. Therefore, while I agree with Mark that the IoT is also about connecting devices seamlessly to one another – it is a “red herring” and completely ignores the role of the “Cloud” in knowledge networking. I also disagree with Mark that all companies will become software companies, primarily because that is too risky! The TMT space is the most disruptive space, ~95% of tech startups fail! I believe they fail because they are highly software integrated with very weak value propositions. We don’t need to look too deeply, the successful software player began by offering clear value to consumers or cost reduction to the firms that do e.g. Google (search), Amazon (retail, then AWS), Uber (transport), Airbnb (accommodation) etc. And although some may have since evolved into software platform providers, their success is down to focusing relentlessly on the value they bring to consumers or the cost they can drive out of the firms that do… Clearly, not all firms will have a “platform” opportunity so it becomes imperative that they avoid ownership of the technology narrative (both HW &SW) in order to remain “agile” with their choices and tech deployments. I therefore submit that their focus must be on the workflows that deliver their continuously evolving value narratives.. using state-of-the-art technology options (even open to contradicting a previous position) in order to exercise their strategic choices and to remain relevant!

Yes – but whether they write their own software (indeed harder) or design proprietary workflows leveraging other people’s software, the broader point is that software becomes the core vehicle driving the value proposition. I agree that not every company has a platform opportunity and not every company should try to hire hundreds of software developers, but a lot of the larger companies on this chart do!

Hi Matt, I don’t think it does… I believe that “knowing what to code is more important than coding itself”… just ask Yahoo, with all its world class coders it remains in the doldrums of value creation. Coding is increasingly a commodity and it would be a grave mistake for firms with clear differentiated value (not software) to become software companies… Moreover, it is a business imperative that they distance themselves from owning any tech narrative, as that is the only way they can avoid the highly disruptive risk associated to a tech narrative. The firms’ underlying value narrative [what customers actually want] is less prone to disruption e.g if I need to colour my walls, no amount of software coding will change that… but I may dip into the digital toolkit to use eCommerce for virtual selling and maybe even open to a digital colour mixing app to provide a more diverse colour palette etc… but only if that is the value my customer seeks… for if I am wrong my digital investment and coding will be wasted; this is precisely why >95% of tech start-ups fail with their highly integrated software stacks that are not correlated with what customers need but more aligned with their own tech narratives….

Matt – nicely done, a deft compendium on the state of the market. I’d like to add Bright Wolf to your radar as a horizontal software platform play with traction. To Christian’s segmentation point, for what it’s worth, we think of IoT as 3 distinct markets: consumer/home, commercial and industrial. With regard to challenges, beyond strategy and business case, but rather at the system / implementation level you may find my latest stream of consciousness relevant: IoT – If It Were Easy, Everyone Would Be Doing It: https://www.linkedin.com/pulse/iot-were-easy-everyone-would-doing-david-houghton

David, thanks for the kind words and putting Bright Wolf on our radar.

Hi, Matt. Good stuff. A few flaws, however. The landscape model assumes that vendors primarily fit into one of those niches/subsegments. With a company like PTC/ThingWorx, that’s simply not the case. The ThingWorx platform + PTC’s offerings would place them in many of the sections of the diagram. The platform is a full stack IoT offering (ThingWorx) that also adds analytics (Coldlight), AR/VR (Vuforia), manufacturing and supply chain capabilities (Kepware/PTC) and a whole lot more.

Arguably, PTC/ThingWorx is *the* “giant” in the industrial IoT, having grown a substantial customer and revenue base.

Thanks Rick and yes, you guys built something quite amazing at ThingWorx. Would love to hear the war stories if you’re in NYC from time to time. (and yes, you rightly pointed the limitations of the landscape format, although we’ll try to reflect your feedback in the next version).

Matt, Great comprehensive roundup and commentary. Kudos also extended to David.

The notion “are we there yet” and your assessment of “what’s taking so long” are spot on. Adoptions generally take longer than predicted. In the case of the IoT, given that it will touch consumers, businesses, governments, products, services, etc., the adoption will surely be measured and evolutionary. IoT penetration is only a question of when, not if. Many of the IoT predictions will come true, what is not yet certain is which products and business models will bubble up first. From my vantage point, I see organizations embracing the IoT into their operations.

Per your request for omissions – I suggest that Space Time Insight, Inc. (www.spacetimeinsight.com) for whom I am a marketer be included in the next update to your list and infographic. The company satisfies your base criteria of having raised venture funding; the company also has products, customers, and ongoing and growing revenue. Space-Time Insights provide a platform and applications that help organizations integrate the IoT into their decision-making and business processes. A unique capability of the platform is its multifaceted method of generating actionable insights by accessing data from static and streaming sources, including IoT streams, and correlating that data to identify spatial, temporal and network interrelationships about “things” and situations. Advanced analytics and visual analytics are applied as well to derive additional insights and prescriptive actions from the data. With regard to the IoT, organization gain comprehensive visibility to – and – interactivity with “things” and their environment. The benefits are insight-driven and hence low-risk decisions and machine to machine automation.

Lastly, Christian (in the first blog post) brings up a relevant and important point that I face all the time in my role – that “IoT” is not single specific a product, or a specific business problem or solution. The phrase “IoT” (and IoE too) is used more and more to connote anything and everything related to the IoT. In other words, “IoT” is becoming a catchall moniker for numerous interrelated items that include technologies and products (semiconductors, devices, software, …), services and business models.

Thanks for the input Ron

Matt, thank you for this great coverage. Your post made me think of things I am dealing with for the IoT and for hardware startups, and I wrote a blog post re: your post. Mine is not so well written as yours, but I hope you get some idea from a different perspective.

https://blog.fabfoundry.net/internet-of-things-can-we-connect-hardware-startups-in-nyc-to-manufacturing-resources-in-japan-to-7e8c81d4288d#.uor8h84nq

Thanks Nob, just shared your post on Twitter. Great read.

Thanks Matt!

Matt – this is one of the best articles on IoT I have read. Thanks for putting together a logical and well thought out piece. I would also add that Hitachi is in the Industrial IoT space too. We have a very strong corporate commitment to this space similar to many of the other large firms you mention. I also can say that with 900 separate Hitachi companies, the IoT initiative is the first in my 20+ years here in which we are working together to push for E2E solutions, because we know that none of us singularly can do it all. Additionally, we are searching far and wide for collaborative partners to help fill in the gaps needed so that requirements like Interoperability, Security, Speed and cost can be achieved. I think the days of proprietary E2E solutions are numbered as open solutions will become the norm & required by rthe end users- much to the chagrin of many of the biggest companies. Thanks for the great work.

Keith, thanks for the kind words and for the perspective. Duly noted.

Hi Matt,

This is indeed a great post. This is something I can truly give to my students for developing an overview and indepth understanding on IoT. What is especially interesting is the image where you have broken down the scope of IoT in terms of groups or clusters of solutions. That is simply profound and extremely interesting, and helps learners connect the dots.

Regards

Dr. A K Kar

Thanks for an excellent piece. I echo David Houghton’s comment above about including the commercial IoT as a third track. At Powerhouse Dynamics, we focus on connecting to equipment (such as commercial refrigeration units, ovens, electrical circuits, irrigation systems, etc.) across a portfolio of small commercial facilities. There are huge efficiencies to be found in restaurant, retail, and convenience store chains through the IoT. One recent example: http://hospitalitytechnology.edgl.com/news/Arby-s-Reduces-Energy-Consumption-by-More-Than-15-Percent104978

Thanks for the well considered post. From our experience developing connected products for clients at Synapse, a few additional points to consider:

– I agree that the “natural cycles of replacement” of many existing analog objects makes the business case for IoT startups less compelling in many markets. I would add that consumers are becoming more wary of connected devices as they see certain companies fail to provide continuing support over the lifespan of the product, and I fear that consumer enthusiasm may wane accordingly.

– Regarding “too many standards and not enough people agreeing among them”: we have been watching various organizations propose networking and application connectivity standards, the latest of which is the Open Connectivity Foundation, and it seems that we are in a phase analogous to where the OSI was in the late 1970’s, before ARPANet converted to TCP/IP and the Internet was born. The OSI got bogged down in issues of openness and consensus and the designers of TCP/IP won via working systems. What is the analogue of TCP/IP for the IoT?

– Regarding the “trench warfare phase” of manufacturing and distribution, it is our experience that a product can go from concept to shelves in roughly half the time you mention, given stable requirements (minimal iteration on design concepts), few to no mistakes in DFx, and a good working relationship with the CM. The typical cause of longer product cycles are DFx mistakes that are not caught through a solid product development process (EV, DV, PV) and require refactoring of hardware design. What do you think are the causes of “trench warfare?”

Cheers

Great post Matt. My only add would be regarding your mention that “telecom companies have been all over the IoT”. You are 100% correct and tech companies that help them with IoT are well positioned, e.g. Jasper Technologies (acquired by Cisco for $1.4B). Carriers occupy the “of” in the Internet of Things. That “of”, which in essence is a communications challenge, can be an incredibly thorny obstacle for IoT product developers. As a result, carriers have a very unique opportunity to provide useful solutions. It didn’t get much press, but last December we closed a substantial (for us) deal with Verizon to include our core flagship products (dweet and freeboard) in their new ThingSpace developers portal. It’s early days but so far the results have been very positive. We are now talking to other non-US carriers to include our tech in a similar way. Every carrier in the world now is worried about Google, Facebook, etc. They have to innovate to stay relevant. IoT represents a great opportunity for them to do that. FYI – VZ just released their own IoT report which is a good read.

Hi Matt, this is a great read and the follow up comments are also insightful and thought provoking. I’d like to ask if you would include TE Connectivity in the Sensors section of the landscape. The company has made a number of investments in this area over the past couple of years and are now probably one of the biggest sensor companies. Thanks.

Thanks for including Simularity in the master database Matt. We are correctly in the Platforms/Analytics group – nice job!

Btw I suggest you remove the Platforms/Software category entirely as most of these companies offer either software or Saas, and place all those affected companies in more targeted Platform Sections. For example wot.io is surely built on software but describes itself as a data exchange, so maybe it should go into Connectivity at the Platform level.

Regards,

Peter

Hi Matt,

Missing from this table is the Israeli startup GreenIQ. So far we raised $3.5M, and we have thousands of customers worldwide. We’re a direct competitor to Rachio that you have on this chart.

Can you please add GreenIQ to your list/chart?

Thank you and best regards,

Odi Dahan

CEO

Hi Matt,

Just came across this blog post from twitter. It’s amazing to see a vast classification of the companies who are dealing in IoT ecosystem. I personally agree with your quote : The IoT today is largely at this inflection point where “the future is already here but it is not evenly distributed”.

Also, let me introduce you to my company – Falkonry. It’s a startup that is focused on how predictions and pattern recognitions can be made more simple and simple; so that no one has to do any machine learning. This makes us a part of IoT ecosystem by making IoT enabled systems more intelligent. You can read more at http://falkonry.com and see how we see IoT as.

Would be great to hear back from you on this.

Excellent post, Matt. You have captured the state of play very well, and identified many of the uncertainties associated with IoT. The biggest of those may be the question of whether investors will be prepared to stay the course if they feel like they’ve asked “what’s taking so long?” too many times. It depends on the answers they get, of course.

Kudos on a thorough overview in constructing the landscape. But seeing as you asked, I have to question the omission of Teradata in the Analytics section. In fact, I’ll even extend that to some of our traditional competitors.

We may be thought of by many purely as a data warehousing provider, but for the past several years we have focused increasingly on the necessity of integration of analytic systems to deliver powerful analytics regardless of the source or nature of the data. That integration has to cover hardware/software, proprietary/open source, on-premise/cloud/hybrid. We win when companies use analysis to drive their business, and Analytics of Things in context of other enterprise data is an essential component of IoT success.

Dear Matt, very interesting landscape.. do you update it once per year? Is there any specific source I should contact to get constant info about the landscape changes? Thanks for your feedback

Hi Matt,

Great job with the map! Seems like GreenIQ is missing from that map. We’re Rachio’s competitors in the Garden category, we have thousands of customers, our valuation based on last round is $7M, and we sell worldwide. Our technology is superior to all the competitors in this segment, and therefore I believe it makes sense to include us on your amazing map 🙂

I’ll be happy to discuss and answer any question. Thank you!

Best Regards,

Odi Dahan

GreenIQ CEO

Matt, this is great work and very helpful. And yes, you missed a vital part 🙂 in the security section which is key management. Providing security hardware, software and OS is one thing, but being able to manage the digital IoT key chain in a way that both enterprises and start-ups can easily and securely implement their applications without the hassle of key creation, derivation, rolling, etc. is another thing.

Check out https://www.ncta.com/platform/broadband-internet/behind-the-numbers-growth-in-the-internet-of-things/ and see what’s at the top of the chart – a lock. That’s where we have started and shipped products for 100k+ IoT enabled hotel door locks. Plus we operate a SaaS which securely transmits access credentials to mobile phones (check out https://www.youtube.com/watch?v=kffmBCN9HPk).

Our team of 60 staff at http://www.legic.com/ would be very happy to appear on the next edition of your map 🙂