“It’s been crazy out there. Venture capital has been deployed at unprecedented pace, surging 157% year-on-year globally […]. Ever higher valuations led to the creation of 136 newly-minted unicorns […] and the IPO window has been wide open, with public financings up +687%”

Well, that was…last year. Or more precisely, 15 months ago, in the MAD 2021 post, written pretty much at the top of the market, in September 2021.

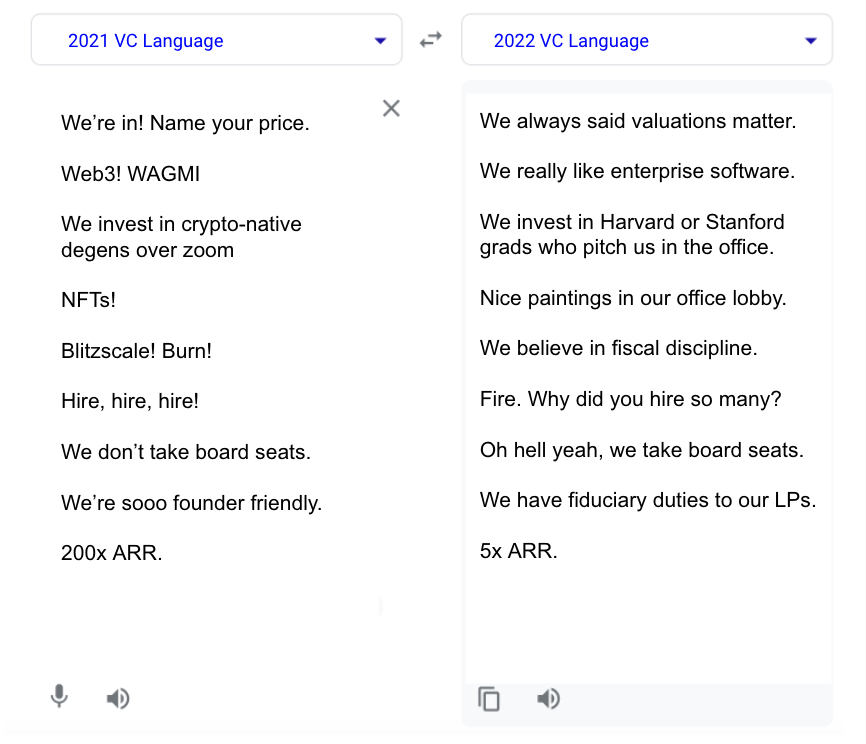

Since then, of course, the long-anticipated market downturn did occur, driven by geopolitical shocks and rising inflation. Central banks started increasing interest rates, which sucked the air out of an entire world of over-inflated assets, from speculative crypto to tech stocks. Public markets tanked, the IPO window shut down, and bit by bit, the malaise trickled down to private markets – first at the growth stage, then progressively to the venture and seed markets.

We’ll talk about this new 2023 reality in the following order:

Continue reading “MAD 2023, PART II: FINANCINGS, M&A AND IPOs “